ArcticZymes Technologies - High-margin supplier to the next generation of Life Sciences

ArcticZymes combines growth of >25% and margins >50%. The company has a valuable position in the value-chain as the supplier of mission-critical raw materials. Find out what makes it special today!

ArcticZymes Technologies is a raw materials producer for the Life Sciences industry based in Norway. The company sells enzymes with particular properties that enable the development and manufacturing of cell- & gene therapies, RNA therapeutics, and diagnostics.

Although ArcticZymes is an incredibly interesting company with bright prospects, I have not added it to the Partnership Investing portfolio yet. I will keep a close eye on the share price. Perhaps the Market Gods will offer me a more compelling entry price for this high-quality Life Sciences company. I wanted to share this exciting company many investors (even experienced Life Sciences investors) have probably never heard of. After all, one of the goals of this newsletter/blog is to share with you the highest-quality companies I find around the world, regardless of size or industry.

Why is ArcticZymes Technologies interesting?

While the exact science of the products ArcticZymes (AZT) produces might not be in some investors' circle of competence at first glance, the business model and competitive advantages of the company are more understandable than one would expect. Companies like Givaudan and CHR Hansen are good examples of what producing a key ingredient in a larger, more valuable process can do for investors. I believe AZT possesses similar qualities and combines them with the advantages of being a key supplier in the Life Sciences industry. In addition to this, AZT profits from a fast-growing end-market where they are well-positioned to retain a large portion of the value they create.

With this write-up, I will attempt to describe the company, its products, and prospects in a way generalists will understand.

Business

AZT is a Business-to-Business (B2B) supplier of raw materials, specifically enzymes, to Life Sciences companies. It currently counts over 300 customers. Its products are mainly used in the development and manufacturing of cell- and gene therapies, molecular tools (e.g. PCR-tests, Next-Gen Sequencing), and RNA therapies. Based in Tromsø, Norway, the company discovered arctic enzymes in the 1990s with particular heat properties that could be used in various workflows. This was the start of ArcticZymes Technologies.

Strategic review and divestment of Betaglucans

During the 2000s and 2010s, AZT then named Biotec PharmaCon, focused its efforts on a wound-healing product named Woulgan. This product was a commercial flop and this unprofitable part of the business, named Betaglucans, took significant focus and resources away from the very profitable enzyme business. In 2019, the situation changed after the launch of the Woulgan product failed to gain traction despite significant investment. The then-CEO left the company and the Betaglucans business was sold for 70M NOK in 2020. The company adopted the name of the enzyme business, ArcticZymes Technologies, and focused on becoming a pure B2B enzyme company. The head of the enzyme business, Jethro Holter was made permanent CEO of the company after starting the restructuring process as interim CEO in 2019. From the very start, he has stated his optimism and ambition to make AZT a mission-critical supplier of raw materials to the next generation of therapies.

During his time as head of the enzyme business, Holter oversaw the expansion of the product line, expansion of the production capacity, and grew the customer base significantly to what it is today. Jethro Holter's presence as the steward of the company is very positive and he is clearly committed to fulfilling the potential he saw internally being neglected under the previous management team.

Products

AZT's products essentially remove impurities during the manufacturing process that might interfere with efficacy or safety. The particular heat properties of the enzymes AZT offers are well-suited to the manufacturing processes and workflows of upcoming cell- and gene therapies (CGT), RNA therapeutics, and molecular diagnostics.

The FDA has strict requirements for the maximum amount of certain types of DNA in therapies and tiny amounts of unwanted DNA can cause inaccuracy in diagnostics tools. AZT's enzymes help clean up unwanted DNA in the manufacturing process or within diagnostics while preserving the quality of the sample. In addition to cleaning up unwanted DNA, the enzymes can be inactivated through heat. This particular property provides a more efficient workflow.

"Looking strictly at the enzyme activity, all of the company’s enzymes have competitors on the market, but few can offer the same combination of cold activity and irreversible heat-inactivation. In fact, this is a key issue in this market that many companies have tried to solve in various ways. If your heat-inactivation “off button” is not 100% effective, you will either need to kill the enzyme by chemical means or you will have to extract the enzyme away from the reaction mix, which generally is associated with time-consuming protocols with many steps and involves a loss of 30-50% of the sample. With the unique enzymes from ArcticZymes, a heat-inactivation at 50-65°C is enough for most enzymes, and this procedure can be combined directly into the protocols with no loss of sample involved." - Pareto Securities Equity Research

To give a comprehensive overview of AZT's products, I will need to explain two things; viral vectors and PCR.

What is a viral vector? A viral vector is a delivery mechanism (like a syringe, but a biological one) that contains a gene that will treat a certain disease. The viral vector is an inactivated virus, often lentivirus or adeno-associated virus. This method is becoming increasingly used to deliver CGT. There are 25 viral-vector therapeutics in late-stage development and 120 in Phase II trials as of February 2022. This number is expected to grow significantly over the next years.

Here is a very simple explanation of CGT. This explanation also covers RNA therapeutics:

What is a PCR? PCR (polymerase chain reaction) is a fast and sensitive method capable of amplifying small numbers of DNA millions of times over. Many will have heard of PCR due to its use in COVID-19 testing. AZT also profited as some of its enzymes are built in these tests.

Now that we have defined what viral vectors and PCR are, I can give you an overview of AZT's main products.

Salt Active Nuclease (SAN) - The FDA only allows a certain amount of remaining DNA in the viral vector delivered to the patient. SAN removes this DNA after heat-activation. Competitor Sigma-Merck's Benzonase is widely used but not as well suited for gene therapies compared to SAN. SAN requires no desalination (salt removal) process, unlike Benzonase. Benzonase sells an estimated $125m a year. AZT is developing variations of SAN suited to certain workflows. Existing variations are SAN HQ, M-SAN (AAV and lentivirus respectively, 2/3's of the viral vectors used), and SAN 2.0. SAN is sold to >100 customers.

Cod UNG - Cod UNG is used to prevent contamination of samples by breaking down unwanted DNA in PCR tests. The Cod UNG enzyme can be activated and inactivated with heat and makes sure the results of the test are accurate. Cod UNG is especially effective when you want to reuse the PCR products after the test as it is irreversibly inactivated by heat, avoiding degradation of the product. Used in tests for HIV, HCV, influenza, and Coronavirus.

Shrimp Alkaline Phosphatase (SAP) – utilized in clean-up prior to Sanger sequencing and Next-Generation Sequencing (NGS) processes. SAP represents the Company´s first product which has been sold since 1995. Even today, SAP still represents the golden standard utilized for enzymatic clean-up in Sanger Sequencing processes globally. (company's own description)

AZT is constantly working on variations of existing products or new products entirely to address larger parts of its customers' workflow. AZT is also aiming to develop products specifically suited to the development of RNA therapeutics, an area they are present in, but where they could deliver much more value.

The company has stated its goal to use its balance sheet to do M&A. The ideal target would deliver production capacity and enzymes that are complementary to AZT's portfolio. Given the emphasis on the M&A goal, I wouldn't be surprised if it happens in the next 12-18 months.

Biomanufacturing and Molecular Tools

AZT splits its business across Biomanufacturing and Molecular Diagnostics.

Biomanufacturing is mostly supporting the manufacturing and development process around CGT and RNA therapies, which are high-growth areas in the Life Sciences industry. This segment accounted for 34% of sales but likely will account for most of the future growth.

Molecular Tools serves molecular research and molecular diagnostics. This segment supports sales to manufacturers of diagnostics tests and companies developing NGS technologies. This segment accounted for 66% of sales in 2021. The COVID-19 pandemic temporarily increased the demand for PCR tests. Most of the pandemic is behind us and I expect this segment to grow slower than Biomanufacturing.

Source: Company Q1 2022 presentation

Because CGT and RNA therapeutics are such a growth opportunity for AZT, I will highlight the commercial potential of both.

Cell- and Gene Therapy

Many industry experts and even the FDA expects fast growth in new CGT. With >1000 trials in the space, the growth expected in the development would multiply this number. The FDA has even stated to aim for 10 to 20 drug approvals a year by 2025, compared with only a handful approved today.

According to the Alliance for Regenerative Medicine, CGT developers have raised >$22B in 2021.

These are the tailwinds AZT is benefiting from and they should do well even if only a part of the optimism materializes.

Source: Scendea

RNA Therapeutics

The effectiveness of RNA and mRNA therapies to combat the COVID-19 pandemic has brought a lot of optimism to this market. According to Allied Market Research, the RNA therapeutics market is expected to be worth $25B by 2030.

Here is a simplified explanation of how the mRNA vaccines work, for example:

This is a quick explanation of RNA therapeutics in general. The first two minutes will give you the basics:

Overview of RNA therapeutics as of January 2021:

Source: The Limitless Future of RNA Therapeutics, Damase et al.

Much like CGT, the amount of RNA and mRNA therapeutics is set to grow and AZT is building products to integrate into the manufacturing workflows. AZT expects to release its first RNA-focused enzyme in 2023.

Competitive advantage

Switching costs: AZT is involved very early in the development process. Once its enzymes are embedded in the workflow, it is very difficult to change. The entire workflow would have to be adapted to compensate for the removal of AZT enzymes and this new workflow has to be approved by the FDA and not adversely affect efficacy or safety. In general, once an enzyme is chosen in the development process, it will be sold for 5-10 years.

It becomes exponentially more expensive and cumbersome the further along the therapy is in clinical trials or even after approval as manufacturing facilities have been set up. This makes AZT's products extremely sticky and provides similar pricing power as CHR Hansen or Givaudan.

High barriers to entry: Not only would a competitor need to solve a problem better or, at the very least, as well as AZT's enzymes, but a competitor would need to foster the same customer relationships as AZT and get the proper ISO certifications. AZT has regular audits by potential and existing customers to determine if they are compliant with current good manufacturing practices (cGMP). This requires significant investment in state-of-the-art manufacturing facilities and expertise/know-how throughout the organization.

Intellectual property: The enzymes AZT produces are patented and cannot be exactly replicated by competitors. The unique heat properties are what make those enzymes so unique and well-suited for cleaning up unwanted DNA. A competitor would have to try to work around these patents but keep the desirable heat properties that are unique to those arctic enzymes.

Management and Ownership

The company is led by CEO Jethro Holter. As mentioned earlier, he was the head of the enzyme business since 2015. Under him, the company was able to deliver new products while the focus was mostly on the underperforming Betaglucans business. Since he took over as interim CEO in 2019 and permanent CEO in 2020, the company has executed its production expansion plans and has signed significant supply agreements with large life sciences companies.

CFO Børge Sørvoll has been with the company since 2014 and has led the divestiture of the BG business.

Both managers, as well as the Director of R&D Olav Lanes, have stock options. These options have a strike price of 89 NOK per share and can only be exercised in 2025-2026. This amounts to multiples of their yearly salary and other incentives are focused on the release of new products, EBITDA, and other commercial milestones.

CEO Jethro Holter currently owns 80.000 shares, or about 5.6M NOK, and has 170.000 options he can exercise in 2025. This is a multiple of his yearly salary if the shares were to perform well. This is decent, although not exactly owner-operator skin-in-the-game.

AZT's Board does not have as much skin in the game as I would like. Although the Board's remuneration is not excessive, Board members barely have more shareholdings than management. However, they have very relevant experience in the Life Sciences industry. Chairman Dr. Marie Ruskrow also has very relevant Finance experience as she was an investment banker at Lazard for 8 years in addition to a long career in Life Sciences.

Most large shareholders are Nordic banks. Other large shareholders are private investors. I see a significant opportunity for institutional investors to discover AZT over the next few years as its quality and role in the growing Life Sciences sector becomes apparent.

Financials

AZT is a very profitable company. The Gross Margins are 97-99% and the growth in the business has outpaced the investments in Operational Expenses, resulting in EBITDA margins of >50% over the last 2 years with excellent cash conversion. With such Gross Margins, growth outlook, and scalability in the business, I would expect some margin expansion potential even with investments in R&D (40% of staff is R&D).

Source: Company Q4 2021 report

For 2022, the company targets 155M NOK in sales. The long-term sales target of 350M NOK in 2025 implies ~30% annual growth. This growth target only consists of organic growth, underpinned by the growing Life Sciences market and the faster-growing sub-market AZT serves.

Source: Company Q1 2022 presentation

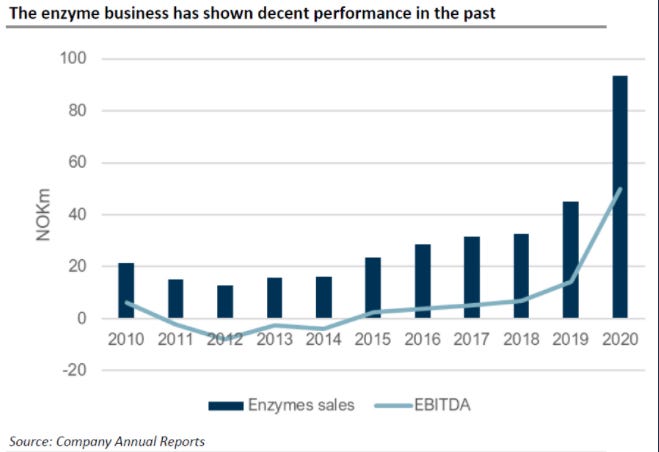

To address potential questions about the COVID-19 benefits the company might have enjoyed, I will add a chart of the historical performance of the enzyme business before the divestiture of Betaglucans.

Source: Pareto Securities Equity Research

As you can see, the enzyme business has been very profitable for a while. Since 2020, the company has consistently disclosed what part of sales is related to COVID-19.

Source: Company Q1 2022 presentation

A decent percentage of sales is related to COVID-19. Management expects some of this revenue to stay as people still need to be tested and tests are used to identify new variants. However, the growth trend ex-COVID-19 is clear, the company is growing and the long-term targets solely rely on growth from other organic sources.

It is not often that you encounter a business with so many tailwinds and this margin profile. With a TAM of tens of billions of dollars, a unique product that adds significant value, and clear competitive advantages, it is difficult to see how AZT can't capture a large amount of the value they create.

Valuation

AZT's market cap is currently 4.3B NOK and has about 200M NOK in cash, which equals to roughly an EV/EBITDA multiple of 37x next year's EBITDA (2023 EBITDA is expected to be ~110M NOK). When looking at the sales target of 350M NOK in 2025 and applying a 55% EBITDA margin, AZT currently trades at 21x the estimated 2025 EBITDA.

This is not cheap, but should it be? After all, AZT has the opportunity to grow fast for the next decade, if not longer. It is not uncommon to see high-quality Medtech/Life Sciences companies trade at high multiples if their growth is durable and the profitability remains intact. What multiple of EBITDA should AZT commend if it executes on its goals and it can keep delivering premium growth/profitability beyond 2030?

I'm not sure I have the answers to this question. What I know is that if AZT can grow its revenue at a 20% CAGR from 2022 until 2030 (something AZT would find disappointing, sell-side estimates this would look more like 25-30%) and its margins stay intact (50-55%), AZT would do ~335M in EBITDA in 2030. Businesses with deep embedding in high-value workflows like CHR Hansen, Givaudan, and West Pharmaceuticals trade at 25-30x EBITDA with growth rates below 10% per annum. Now, these are very high-quality companies with incredibly durable and predictable business models, but I do see lots of similarities between them and AZT.

I find there are compelling reasons to underwrite such a trajectory, but I also believe there are probably more interesting opportunities out there that require less confidence in fast growth in the far future.

Conclusion

ArcticZymes Technologies is one to watch. It is experiencing explosive growth with its established product lines and balances this with incredible profitability and cash generation. The end-markets it is serving are at an inflection point and the customers AZT serves focus on efficiency, quality, and relationships instead of price. AZT is led by a CEO that recognized the hidden value in the enzyme business and now leads it free of distraction (similar to Naked Wines). With ambitious goals, a cash-generation machine, and a strong balance sheet, it is now up to him and his management team to execute this vision. Becoming a true picks-and-shovels provider to the next generation of therapies is likely to be a very profitable endeavor for AZT. The results for shareholders will depend on how profitable it can become, top-line growth over the next decade, and the price they pay for it.

Disclaimer: Always do your own research. This is not investment advice and for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blog.

That one came under pressure big time....