Cardlytics - A unique ad-tech platform with immense potential

Cardlytics has a unique opportunity to become a natural monopoly. We explore how Cardlytics could execute on this promise and what risks investors must consider.

Cardlytics is an advertisement platform founded in 2008 by Scott Grimes and Lynn Laube. The company provides advertisers an opportunity to advertise within online banking apps in the United States and the United Kingdom. Cardlytics counts 170m Monthly Active Users (MAUs) across both regions.

Financial facts:

Enterprise Value: $2.33B

Market Cap: $2.39B

TTM Billings: $416,1M

TTM Revenue: $244,15M

TTM Adjusted Contribution: $115,2M

TTM Adjusted EBITDA: $(10,3M)

MAUs: 170M

New format and what to expect

As mentioned in our Q3 update, we will be writing-up companies that interest us for various reasons. These write-ups will be more qualitatively focused and we will not share any financial projections as we have in previous write-ups. The write-ups of companies that are not additions to the PI portfolio (such as this one) will attempt to give a good understanding of the business and why we find it interesting. We will share our opinion on certain aspects of the business and will refrain from making any financial projections. Because many of the businesses we follow are businesses that we deem to be investable, it is very much possible that we will write the company up in the future when we have added it to the PI portfolio and we will share our financial projections then. Consider this kind of write-up as a business-oriented post and the write-ups where we lay out our investment case stock-oriented posts.

Why we are interested

Cardlytics is an interesting company to follow for several reasons. Firstly, we are compelled by the unique data and advertising channel the company offers. The company has created a network in which every constituent seems to benefit, whose ultimate potential is very large and has characteristics of a natural monopoly. Secondly, the bulls and bears are very vocal on why they love/hate the company. What makes this especially interesting is that both sides seem to have legitimate arguments for their case. Ultimately, we think the distinction between bulls and bears boils down to the perception of the platform as something that not many will use in the future, that won’t scale, and/or whose economics at maturity are not attractive enough to justify paying the multiples the shares are valued at.

Business overview

The story of Cardlytics starts with its founders, Scott Grimes and Lynn Laube. Both founders were bankers at Capital One in the US and realized that banks had huge amounts of data that would be of interest to advertisers. Just imagine what the bank where you hold your primary bank account could know about you and your spending habits if it ever cared to analyze the data. Spotting this data that was not yet monetized, the founders started Cardlytics with the aim to help banks monetize this data. Cardlytics built an advertising platform and its first large bank partner was Bank of America (BofA) in 2010. Cardlytics later managed to onboard the other large banks (JPMorgan Chase in 2017/18 and Wells Fargo in 2019) and several mid-sized banks. By 2020, Cardlytics had data on 50% of spending in the US and relationships with Santander and Lloyds in the UK. To give an indication of the acceleration of the business between 2017 and 2020, Cardlytics went from 54.9M MAUs to 155,8M MAUs. While the Average Revenue per User (ARPU) did not grow proportionally to the MAU growth, there are several reasons to believe Cardlytics will be able to increase the monetization of its users in the future. In this post, we will walk through the paths Cardlytics can take to make this happen and what that would mean for Cardlytics’ future economics.

The business model

Cardlytics had created an advertisement platform that, through partnerships with banks, shows discount offers to consumers on their online banking app or website. The banks, referred to as Financial Institutions (FIs), integrate their transaction data with Cardlytics. The data is anonymized and attributed to unique users numbers. Cardlytics can use this transaction data to show targeted advertisements to users and can use the transaction data to track the return on ad spend (ROAS). Cardlytics has insight into half of the transactions in the US through their partnerships with regional FIs and major banks like Wells Fargo, Bank of America, JPM Chase, and US Bank.

Users can redeem offers by activating them in the app or on the website, and they will automatically get the cashback whenever they use their card to purchase at the retailer. Total advertiser spend on the platform is referred to as Billings. About ⅓ of billings go to the users in the form of cashback. What is left over is Cardlytics revenue. Cardlytics has revenue-share agreements with the FI partners, the split is about 55/45 between the FI and Cardlytics. In short, Cardlytics gets ⅓ of what advertisers spend, the banks get another ⅓ and the consumer gets ⅓.

Why everyone wins

In our opinion, Cardlytics creates value for everyone in the ecosystem. The consumer gets a cashback offer at a variety of retailers. Who doesn’t like to save money? Especially if the ad is well-targeted. The user can choose to redeem offers that are relevant to him. The value for the users is clear. We will explain our view of the value delivered to advertisers and FIs separately.

(Source: @Swany407 on Twitter)

Advertisers: Cardlytics offers the advertiser an advertising channel that is brand-safe and has a unique data set to target consumers. The online banking app or website is brand-safe in the sense that it does not have the controversial content you might find on other popular online advertising channels. Twitter, Facebook, Instagram, and other social media have many users and can target users very effectively (mainly FB). The mobile banking app is an environment trusted by consumers. Advertisers can safely engage with over 170m MAUs (as of Sept 30 2021) in this trusted environment.

What Cardlytics offers advertisers and, in our opinion, makes them unique is their access to a large amount of transaction data from the FIs. Companies can access credit card data sets, but not at the scale and specificity that Cardlytics has. Cardlytics can target consumers with accuracy, opening up many possibilities for advertisers to show dynamic and targeted ads. They can then track the incremental spend to the penny thanks to their access to the individualized transaction data. A few years ago, Cardlytics lacked the scale to be an interesting advertising platform for many large advertisers. With 170m MAU’s those days are over and advertisers are more interested in the possibilities Cardlytics has to offer.

Cardlytics has shown many examples of advertising campaigns with 5x ROAS or more. As more advertisers start advertising on Cardlytics, the more varied the offers MAUs are shown will be. This has the potential to increase engagement from MAUs significantly and thus drive the Average Revenue per User (ARPU) higher.

An advertiser can use Cardlytics to target a user that gets a coffee every morning at the local Starbucks. The advertiser, say, Dunkin Donuts, could show an offer to purchase a coffee at the Dunkin Donuts down the street of Starbucks. This is a simplified example, but the potential specificity of the Cardlytics platform can be much more elaborate. We will discuss the current limitations and potential of the platforms’ capability later on.

FI partners: The Cardlytics platform is a way for FIs to monetize their existing data and diversify their revenue streams. Without talking about macro issues and referring to low-interest rates, it is clear that this partnership provides an additional revenue stream to banks. Not only do banks share in the revenue Cardlytics gets, but user engagement with offers drive spending using the bank-issued card. Banks get paid interchange fees when their clients use their cards to make a purchase. With these offers, banks can drive incremental spending and save their customers money. The total economic value the FI partner captures is the added revenue of incremental spend, the benefits of retention of the user and, the revenue share with Cardlytics. This economic value comes at little cost to the FI, except for the costs of maintaining the relationship and keeping Cardlytics integrated. Cardlytics is responsible for the development of the platform, acquiring maintaining, and relationships with advertisers.

A little back-of-the-envelope math to illustrate the economic value of the platform to the banks:

BofA contributes about 30m MAUs to Cardlytics.

ARPU at BofA was about $3.00 in 2019, according to management. This implies $4.50 per user in ad spend (advertisers pay 4,50, 1,5 to the consumer, rest is revenue for Cardlytics, 50% of revenue to bank). At 5x ROAS, (4.5 x 5) $22,50 incremental spend per user and about 1% of that goes to issuer bank in interchange/transaction fees. So, $22,50 x 30m = $675m. $675m x 1% = $6,75m incremental interchange fees. $1.5 per user goes to BofA as revenue share, so 30m x $1,5 = $45m in revenue share. Excluding churn reduction and other side effects, this implies about $51,75M extra revenue for BofA through partnering with Cardlytics. This calculation is not precise but should provide a floor of what banks can expect in economic value from this partnership.

With all these economic benefits to the banks, why would they not just do it themselves? Well, we believe it comes down to economies of scale. Let us elaborate.

The largest bank in the US is JPM Chase. JPM contributes about 50M MAUs to the Cardlytics platform. To build its own advertising platform, JPM would have to build a team to build the technology and a team to acquire and maintain advertisers. This would take considerable time and resources, especially when you consider that Cardlytics had difficulties getting advertisers on board as a sub-scale ad platform in the past. If JPM were to start its own platform, it would have to duplicate the costs of maintaining the relationship with an advertiser, while Cardlytics can leverage the same costs across 2,5x the MAUs. Additionally, being sub-scale would preclude many advertisers from even advertising on JPM’s ad platform. This would reduce the variety of ads and by extension customer experience and engagement. It sure sounds a hell of a lot easier to let Cardlytics manage it all and just have a team to maintain the Cardlytics integration in exchange for a ~50/50 revenue split. Essentially, we think the bank is better off working with Cardlytics and that not only are they better off, but their customers also are.

Platform potential and shortcomings

The Cardlytics platform has both immense potential and significant shortcomings. This is where both bulls and bears have very valid points and where investors should try to evaluate the capability of the company to execute on its potential. To start off on a positive note, we will try to list the reasons to be optimistic about the platform first and we will list the shortcomings of the platform later. Finally, we will talk about what the company is doing to address these shortcomings and what the future Cardlytics platform could look like.

Targeting capabilities due to unique data set: The Cardlytics platform has visibility into half the transactions in the US. There is no other platform with this data and it is impossible to replicate, except by stealing the relationship with banks from Cardlytics. Advertisers are able to target customers based on spending habits and patterns, including the location of the customer purchases. Starbucks could, for example, target a customer that buys coffee every morning at Starbucks but offer a discount if he buys coffee in a certain time slot where Starbucks has few customers. They could also offer a discount to go to another Starbucks that is still close but has excess capacity compared to his regular location. This is a relatively simple example, but we would recommend you listen to one of the Cliff Sosin interviews linked at the bottom. Cliff does a great job explaining the immense amounts of possibilities advertisers could have when able to target based on wallet-share (how much % does the advertiser have of your spend in a certain category) and other spending patterns. With an understanding of the platform and a bit of creativity, you could think of several interesting ways to direct customer spending through the platform.

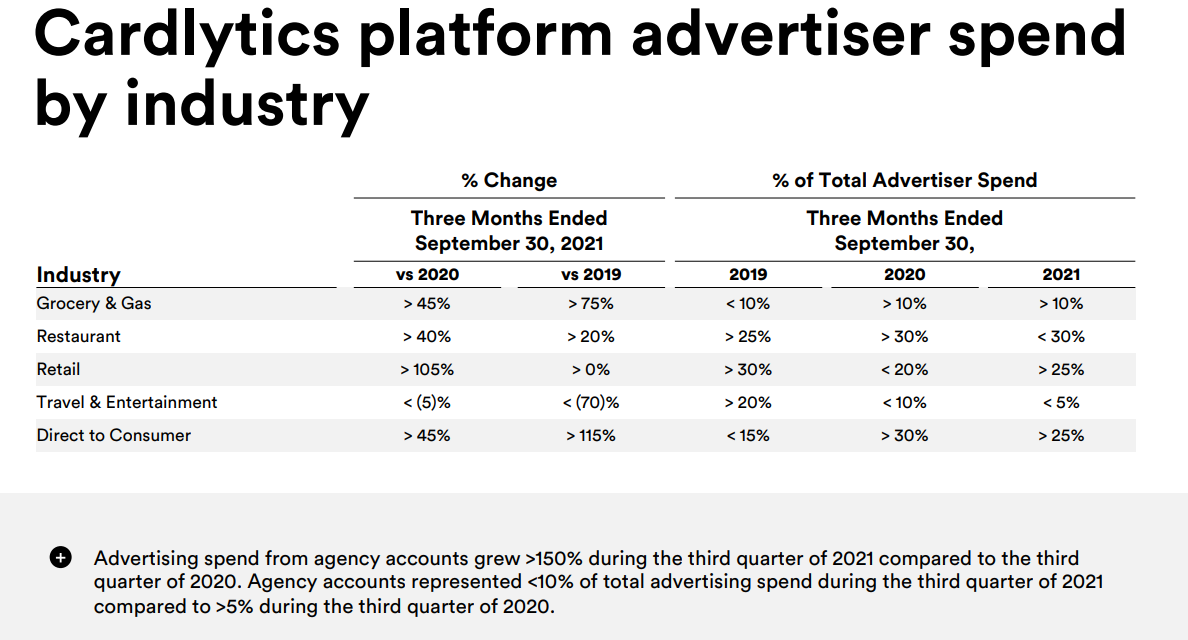

Increased engagement and advertiser spending despite COVID headwinds and shortcomings: Travel & Entertainment and Retail were large categories of advertisers on the platform in 2019. Both these categories cut advertising (almost completely) and both are still mostly recovering. Travel & Entertainment is still down 70% in Q3 2021 vs Q3 2019 and Retail has not grown compared to 2019 (the category was down >50% in Q3 2020 vs 2019). This means that Cardlytics has been able to acquire new advertisers in other categories and grow ad spend from existing advertisers to make up for this drastic revenue loss.

Closed-loop measurement of ROAS: This part is both a plus and a minus for Cardlytics. Through its access to transaction data, Cardlytics is able to exactly measure to the penny what the impact of an advertising campaign is. They can literally look at your previous spending and compare it to when you were shown the ad and compare your spending to someone similar that did not receive the offer. While this is wonderful, many advertisers have trouble with this system and do not fully know how to compare Cardlytics’ performance to other channels where a multi-touch attribution model is used to measure performance (Multi-touch attribution is a marketing effectiveness measurement technique that takes all of the touchpoints on the consumer journey into consideration and assigns fractional credit to each so that a marketer can see how much influence each channel has on a sale, source: Nielsen). This point is a plus when the advertiser understands and trusts the measurement method, but can also be a barrier to spending with Cardlytics if the advertiser does not. Cardlytics uses third-parties like Nielsen to validate their measurement in order to tackle this barrier, but our research indicates that advertisers are still not entirely sure how to deal with the closed-loop measurement.

Now, we will shift our attention to what the platform currently lacks to attract more advertisers and a greater share of ad spend.

UI/UX (User interface / User Experience) offers limited customizability and visibility within the banking app: This is quite a significant shortcoming. The Cardlytics platform currently only allows for offers that display a logo and a discount/offer. This is a huge limitation as advertisers would love to put more effort into the imaging and ad copy to increase the performance and branding of the ad. Although this is a feature that sounds fairly basic in nature, the relationship with banks makes it difficult for Cardlytics to implement changes and add features to the platform. These changes have to get reviewed, approved, and implemented by the bank’s bureaucracy and, as mentioned earlier, the banks are notoriously slow and conservative. The same could be said about the way offers, in general, are presented within the app. Cardlytics has terminated its agreement with Citigroup because they buried the offers section within the app. To get customers to engage with the offers, they must first and foremost be visible. Cardlytics is currently reliant on the banks for how the offers are displayed and the UI.

Cardlytics lacks data on an SKU level and cannot currently provide SKU level offers: Because Cardlytics has only access to data that can be read on card statements, they can see where you made a purchase, but they do not see what you bought. This means offers are currently only available on a retailer level. This precludes many advertisers from advertising on the platform as they have no interest to give a discount on a store/retailer level, but would like to direct consumers to spend on certain SKU (Stock Keeping Unit, an individual product). This also precludes higher spending by existing customers (Starbucks would, for example, prefer to push you to higher Gross Margin products). Many brands, like Procter and Gamble for example, would probably love to advertise on the platform for their products. With the current platform, this is not possible.

Cardlytics lacks a self-serve platform to address small- to mid-sized advertisers and advertising agencies: The real money for an ad platform is when advertisers can control and organize their own campaigns through a so-called self-serve platform. Most of Cardlytics’ revenue is currently from advertisers that work together with Cardlytics staff to launch and maintain campaigns on the platform. While this is a great way to introduce advertisers to the platform, this doesn’t scale very well. By allowing agencies and businesses to manage their own campaigns and spend on the platform through a self-serve platform, Cardlytics would make its business more scalable, increase the variety of offers and address a much larger TAM.

However, Cardlytics is moving fast to address these shortcomings and these initiatives should start to bear fruit in 2023 and beyond. The question remains if you believe Cardlytics is able to execute on these initiatives and if those initiatives deliver on their promises.

Here is how Cardlytics addresses these shortcomings:

New UI/UX pilot with US Bank delivers promising results: Cardlytics announced during its Investor Day 2021 that they had launched a pilot with US Bank with a new ad-server. This new server addresses the UI/UX problems discussed earlier and allows for much faster changes within the platform. The early signs of this are said to be very encouraging and the company hopes to switch most FIs to the new server before 2023. A better UI/UX should benefit engagement, ROAS and, ultimately, ad spend on the platform.

Self-serve platform pilot and wider launch to agencies: Cardlytics has developed a self-serve platform that has been in beta for a while and will be distributed more widely in 2022. The early feedback on this has been positive and the number of advertising agencies that advertise on the platform has grown. Currently, about 10% of revenue comes from agencies and management expects this figure to grow towards 50% in the medium to long term.

Acquisition of Bridg to provide SKU level data: Earlier this year, Cardlytics has acquired Bridg. Bridg is a software company that retailers used to track customer spending within their store. The software is mainly used to track and recognize those customers that are not engaged in a loyalty program. Cardlytics aims to leverage this data to have SKU level data and to be able to offer SKU level offers in the future. The Bridg integration is almost done and they are already launching pilots of SKU level offers with US Bank. If Cardlytics does a good job leveraging this data, they will be able to show many more offers to their MAUs and attract more ad spending.

The platform is still some ways away from being where it needs to be to attract billions of dollars in Billings. Although Cardlytics is addressing many of these shortcomings and the platform should be significantly improved by 2023/2024, we cannot ignore the execution risks. Cardlytics needs to first put itself into a position to attract those billions of dollars of Billings, and then needs to execute well to actually attract them. This is no mean feat but, if successful, should deliver a tremendous amount of value to patient shareholders.

The Super-app boom: Opportunity or nemesis?

It is known to anyone who has followed the Fintech world that the largest companies have Super-app ambitions. What do we mean by Super-app? A Super-app promises to be a single app where you can handle all your financial needs. From payments to savings/checking accounts to Buy Now, Pay Later (BNPL), and even investing and small loans.

Fintech and payments behemoths like PayPal and Square and lesser-known, but high-growth names like Affirm, Afterpay (acquired by Square), and Klarna have started building their offerings with the ambition of being the default choice in anything related to personal finances. Some are further along than others but the ambition of these Fintech players is clear.

These initiatives threaten the traditional banks by having a product/experience that appeals to the younger demographics. Industry experts and executives predict a future where no one has to deal with a bank, but a single Super-app will be able to handle all their day-to-day financial needs. While others are less optimistic and still see a role for traditional banks in the future, there is no doubt that with technological innovations and a ton of capital flowing into Fintech start-ups there are valid questions about the long-term future of traditional banks.

Now, how does Cardlytics try to deal with this emerging threat? Cardlytics could lose its unique position as consumers leave banks for neo-banks and Fintech companies, or, it could partner with these emerging digital players to offer its solutions to their users. Earlier this year, Cardlytics acquired Dosh. Dosh is essentially the Cardlytics for neo-banks and Fintech companies. Instead of building out its own integrations for these neo-banks, Cardlytics acquired Dosh and will integrate their platform with Dosh to make advertising on both platforms possible.

The acquisition of Dosh is quite interesting, especially as one of its best-known customers is none other than Venmo, the PayPal-owned social payments company. What makes this even more interesting is that PayPal has acquired Honey in 2018 for $4B. PayPal could run ads through Honey, but they have chosen to work with Dosh instead.

Neo-banks and Fintech companies might well choose to leverage Cardlytics’/Dosh’s existing ecosystem of partners and advertisers to advertise in their app like Venmo does today through Dosh. This would turn the threat into a great opportunity for Cardlytics. Even though we have no data on this, it would be fair to expect that customers of these digital banks are more engaged with the (Super-)app than customers of traditional banks. Not only is this due to them being more digitally savvy, but these Fintech companies are all about increasing engagement. PayPal and Square’s move to offer crypto trading is a great example of how they are relentlessly trying to increase engagement. Working with these companies is surely more pleasant for Cardlytics than working with traditional banks. New updates, enhancements, and features could be implemented much faster than currently possible with traditional banks.

An example of the Dosh/Venmo partnership (Source: @Swany407 on Twitter)

There is one aspect of the emergence of these Fintech players that we are not comfortable with yet to add Cardlytics to the Partnership Investing portfolio. Square, PayPal and eventually fast-moving companies like Affirm and others have the potential to achieve a tremendous amount of scale. PayPal and Square already have an immense amount of users and are already experimenting with offers to customers.

These offers do not seem to be powered by Cardlytics and this begs the question: Will these companies be able to do this on their own?

Unfortunately, we think they might. Cardlytics has a tremendous amount of scale with 170M MAUs, but it is not that far-fetched to see Paypal or Square achieving a similar scale, with Paypal already having >2x the scale on a global level. Affirm has recently launched offers and it is currently unclear if Cardlytics or Dosh are involved. BNPL companies like Afterpay (now part of Square), Affirm, Klarna, and now also PayPal. have access to the SKU level data that has been so elusive to Cardlytics until recently. These companies can see exactly what you bought, instead of just where you bought something, and can also measure the effectiveness of offers using a closed-loop measurement method. In addition to this important data, these companies seem very able to use this data well; they are able to attract top-level talent from around the world and they are very likely to figure something that works out. While Cardlytics currently still has an advantage because of how much data they have, this advantage might erode as these Fintech players grow larger and they have SKU-level data from the start.

It will be interesting to see how these changes in competitive dynamics unfold and if Cardlytics can use these changes to their advantage or if they become collateral damage.

Conclusion

We find Cardlytics to be an extremely interesting case. The company seems to have the makings of a natural monopoly in a unique advertising channel. They have launched initiatives to solve the shortcomings of the platform and have finally reached the scale needed to be a serious option for advertisers. This setup provides a clear bull case if they can execute well on it in the next few years. On the flip-side, the company has been in existence for >10 years and still has not reached a profitable scale and questions remain on how much economics they can take from their bank partners (Does Cardlytics rely more on the bank’s app than the bank relies on Cardlytics?). Their bank partners are also worrying about well-funded competitors in the form of Fintech companies. These talent magnets with tons of capital are coming into the space and could seriously rival Cardlytics’ scale if and when banks start to lose their younger customers to these “Super-apps”.

Recommended resources:

Follow @Swany407 on Twitter for frequent updates on Cardlytics and the platform

Feel free to contact us on Twitter @PartnershipInv or by e-mail partnershipinvestingblog@gmail.com.

Disclaimer: Always do your own research. This is not investment advice and for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blog.