CellaVision (CEVI-ST) - Bringing blood testing into the Digital Age

CellaVision has the marks of a high-quality business. It has demonstrated an ability to grow very profitably in an attractive niche. Find out what makes CellaVision so special in today's post!

Why is CellaVision interesting?

My opinion is that CellaVision is particularly interesting to investors looking for high-quality small-cap companies. This has been the focus of this blog/newsletter and CellaVision has been on my radar for close to a year.

CellaVision operates in the very profitable Medtech/Diagnostics industry. Companies with durable competitive advantages in this industry have tended to be very profitable investments for shareholders over the years, deserving premium valuations and profit margins. CellaVision has been no exception with a 17,65% CAGR in share price over the past 5 years. Despite its dominant market position in a niche part of the Medtech/Diagnostics industry, there are reasons to believe CellaVision is not done growing and should be a larger company in a few years than it is today.

Today, you will find out why CellaVision is worth researching if you are looking for high-quality businesses.

Business overview

CellaVision was founded in 1994 by Christer Färhaeus. The company initially sold blood analyzers and later introduced solutions to digitally analyze blood samples. Analyzing samples digitally is referred to as Digital Cell Morphology (DCM), something CellaVision has been the market leader in for the last 20 years.

To understand DCM better, it is necessary to understand the workflow of which it is a part. When patients submit blood samples for testing, the sample first goes through what is called a cell-counter. CellaVision describes this process as follows:

“It is estimated that about four billion tests are carried out around the world every year. In about 15 percent of cases, the cell counter indicates the need for more in-depth microscopic examination of the blood cells with a differential blood count.”

After the cell counter, the examination is usually done manually with a microscope. Larger laboratories can prepare the samples for analysis automatically, while smaller laboratories need to do this manually. The accuracy of results can be off if a part of this process is not done well and the time it takes to get it done is dependent on the lab technician’s proficiency. If another test is needed, the sample needs to be sent to another laboratory for analysis, which adds considerable time to the response time.

CellaVision, however, has developed advanced image technology and software to automatically identify cells:

“CellaVision analyzers automatically find the correct area of examination and pre-classify the cells. The result is shown digitally on a screen. The pre-classification is reviewed and assured by a Medical Technologist who makes adjustments if necessary. Using the digital process, the results can quickly and simply be shared with colleagues and morphology experts in other places.”

A graphic of the workflow, with green showing the parts where CellaVision offers their products.

Source: Annual Report 2020

When putting both workflows side to side, it is obvious why DCM has been so successful. CellaVision’s reputation as an accurate, reliable, and cost-effective tool has been established for more than a decade. Studies have demonstrated that CellaVision’s analyzers are on par with manual microscopy. The time these analyzers save overwhelmingly outweigh the occasional limitations they may have.

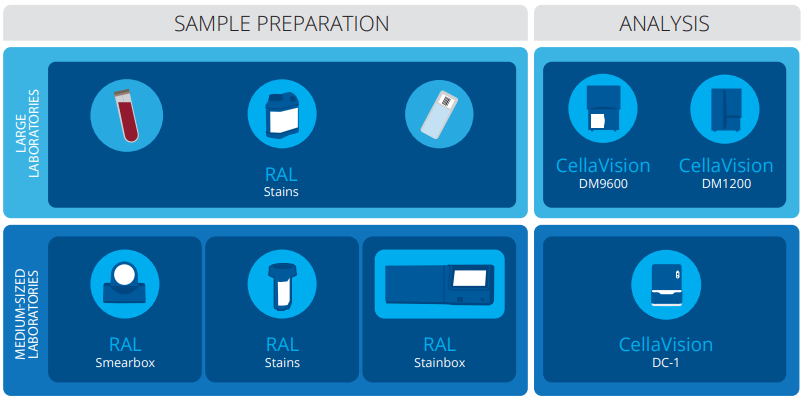

As of 2021, CellaVision is about 22% penetrated within large laboratories and the largest DCM provider in the market (>80% market share). There are about 17k large laboratories and about 25% of blood test in those laboratories is done with a DCM analyzer. CellaVision has had the most success within the large laboratories as the volume justifies the relatively high costs of the CellaVision analyzers, software, and consumables. CellaVision has recently released a smaller analyzer (DC-1) with the aim to target mid-to small size laboratories. This is a part of the market where CellaVision has little to no footprint and the 100k laboratories within this segment is a large opportunity the CellaVision is now just addressing.

The analyzers CellaVision offer now span the entire spectrum of laboratories:

- DM9600: For high-volume laboratories

- DC1200: For large- and medium-sized laboratories

- DC-1: For medium- to small-sized laboratories

In addition to human diagnostics, CellaVision has tailored its analyzers for animal testing. While it is still early days, the company has indicated its goal to increase its position within the Veterinary Diagnostics market.

Razor/razorblade model

Like many other companies in the Medtech/Diagnostics industry, CellaVision has a Razor/Razorblade model. The analyzers that are currently in use form the installed base and clients order consumables regularly to use it. CellaVision already has a significant installed base amongst large laboratories and it is now setting its sights on smaller laboratories, veterinary laboratories and developing solutions for different types of specialty analyses. This, according to the company, constitutes a 3B SEK market opportunity.

In 2021, CellaVision generated 58% of its revenue through Instruments (this includes consumable instruments and the analyzers), 26% from Software and other (e.g. spare-parts), and 16% from Reagents. Note that the Reagents part comes from the acquisition of RAL Diagnostics in 2019. RAL Diagnostics provides sample preparation products to the same client base as CellaVision. By acquiring RAL, CellaVision can offer a broader product range and own a larger part of the workflow.

Source: Annual Report 2020

Financials

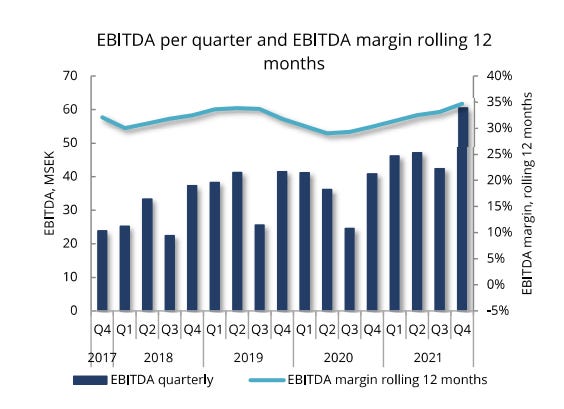

Revenue for 2021 amounted to 566M SEK. This amounted to 24% organic growth. EBITDA for the year was 196M SEK. Gross Margins were 69% and the EBITDA margins were 34,6% in 2021.

The previous year (2020) was difficult for CellaVision as revenues declined 10% excluding the RAL Diagnostics acquisition. This is still quite resilient considering the COVID-19 pandemic environment. CellaVision’s EBITDA margins would still make many companies jealous during the 2020 pandemic year, coming in at 31%.

EBITDA margins have constantly expanded for the past decade, starting at 15% in 2010 to ~35% today.

Source: FactSet

Free Cash Flow was about 120M SEK, excluding the acquisition of a portfolio of patents/technology. CellaVision has less than 500M SEK in tangible assets and 545M SEK in Equity. The Return on Capital metrics are definitely good for CellaVision, especially as they probably have some excess cash they could reinvest or distribute. According to FactSet, Return on Invested Capital (ROIC) has averaged 26% in the last five years and Return on Equity (ROE) has averaged 28% during the same period. Looking back a decade, CellaVision has generated a ROIC and ROE above 20% since 2014.

Source: Q4 Earnings release

Source: Q4 Earnings release

The company has established a strategy to achieve 15% revenue growth and 40% EBITDA margins by 2026.

Source: Company presentation

We have now discussed what CellaVision does, its strategy, and financial profile. Next, we will go through what I think their competitive advantages are and how durable they are.

Competitive advantage

Switching costs: CellaVision benefits from high switching costs. The healthcare industry is characterized by high costs of failure. The blood samples analyzed are used to make life-saving medical decisions. An inaccurate or unreliable result could have dramatic consequences for patients. Reliability, accuracy, and replicability are understandably paramount to decision-makers. To this end, CellaVision analyzers form an integral part of a lab technician/technologists’ workflow and the hassle associated with re-training them would make the entry of a competitor very difficult. A competitor offering a similar product would have to demonstrate much more time savings or offer a similar product at a much lower price than CellaVision to entice laboratories to make the switch. Marginal efficiency gains or lower prices are quickly negated by re-training costs, the time needed to achieve full proficiency, and the risks associated with walking away from what has been the industry standard for two decades.

Data advantage: I must preface that I usually find a data advantage a weak/unreliable source of competitive advantage. There is a lot that we don’t know about how data can actually be a moat, but I think CellaVision is a good example of how being first and having the most scale can actually give your product an advantage through the acquisition of data.

Remember, CellaVision uses software to pre-identify and label cells within a blood sample. The technologists then can approve these identifications or re-identify them. This forms a feedback loop that is innate to the product. For decades, CellaVision software has been identifying cells and getting immediate feedback from trained professionals. CellaVision uses this data to train the software to be better at pre-identifying cells, which saves the lab personnel even more time.

The advantage comes from CellaVision having a 20 years headstart against potential competitors and CellaVision have 80-90% of the samples analyzed digitally processed through their software. The scale of their data compared to any competitor makes it increasingly difficult to create a comparable product and/or to keep up with them.

Management and ownership

CellaVision has recently had some management turnover, which is a reason why I am not in a rush to buy shares as of yet. The previous CEO did a great job and has left after he got the opportunity to lead a larger company. His departure did not seem to be caused by any turmoil at the company. The new CEO, Simon Østergaard, was one of the leaders of the Diagnostics and Genomics division of Agilent Technologies. This division was responsible for over $1B in revenue in 2021. His experience in Medtech/Diagnostics spans over a decade at different leadership levels.

The CFO Magnus Blixt has announced he will leave the company for a CEO role at Dignitana AB, another Swedish-listed Medtech company. The search for a new CFO is currently ongoing.

CellaVision founder Christer Färhaeus is still involved with the company as Chairman of the Nomination Committee and Board member. He still holds 9.6% of the shares.

William Demant A/S, a Danish-listed hearing healthcare company, owns almost 20% of the shares. William Demant also holds ownership stakes in other Medtech companies like Revenio (an interesting company in its own right) and Jeudan, the largest real estate investment company in Denmark.

Gren Specialisten, through Grenlunden AB, holds 10% of the shares. This company/holding is owned by Axis Communications founder Martin Gren and TePe (mouth hygiene company) owner Joel Eklund. Grenlunden is represented on the Nomination Committee alongside Christer Färhaeus, William Demant, and SEB Funds.

This is a set of long-term-oriented business owners that have the same interests as common shareholders. CellaVision is owned by the type of shareholders you’d like to partner with.

Østergaard seems like a competent CEO that can be the right person to grow CellaVision and achieve the goals laid out earlier. His lack of experience as a CEO of a publicly-traded company could be worrisome, but the strategy he has communicated since arriving makes sense and seems achievable.

Despite this and a strong shareholder base, my recent experiences with companies’ management turnover, and the adverse results that can arise from a poor management transition, I choose to wait and see if the CEO and incoming CFO can deliver on their promises. In a global universe of high-quality businesses, surely I can find situations where management is no issue or even a strong reason to invest.

Valuation

CellaVision’s market cap is currently ~7.5B SEK, or ~ €750M, with no debt. The company has a predictable business model in a very profitable niche where CellaVision is positioned to address a larger part of the market. CellaVision does not need to reinvest much of its cash flows to grow and prefers organic growth above M&A. Their returns on capital are excellent and the company has committed to return capital to shareholders through dividends. I believe this is a business that deserves a premium valuation due to its recurring business model, attractive industry, and growth prospects. How much of a premium valuation it deserves is highly dependent on growth and the duration of the growth. Its growth ambitions have been stated in the last earnings presentation, aiming for 15% growth in revenue per year and at least a 40% EBITDA margin by 2026.

The stock currently trades at 32x 2022 EBITDA projections by the sell-side. If we were to take management’s guidance at face value, revenues would grow from 566M SEK to 1138M SEK in 2026. At the guided EBITDA margin of 40%, this implies 455M SEK in EBITDA in 2026. At a 7500M SEK valuation, the stock currently trades at 16.5x 2026 EBITDA. This leaves little room for error to achieve a satisfactory return, depending on what exit multiple you believe CellaVision should trade at by then. Additionally, CellaVision does not convert all its EBITDA into Free Cash Flow, and Free Cash Flow is really what a business is about. Looking at consensus estimates, CellaVision trade at 40x 2024 Free Cash Flow, or a 2.5% FCF Yield in just under 3 years.

This is a bit too pricey for my liking, especially considering my thoughts on the management situation and the comparable companies one could buy today.

Conclusion

CellaVision is a great example of the type of business I am looking for at Global Quality Investing. A small business that is able to demonstrate profitability while growing at sustainable rates over long periods of time. CellaVision is active in an attractive industry where price is less of a consideration and where digitalization can bring valuable efficiency gains through the entire value chain. It has established itself as a leader in its market with competitive advantages and an industry standard for its clients. Investors can invest alongside strong and long-term-oriented business owners that can exert significant influence over the company’s direction.

I will not add CellaVision in the Partnership Investing Portfolio for valuation reasons and due to heightened care about management stability, but I will follow the company closely as part of my watchlist.

I have encountered a plethora of interesting small Medtech/Healthcare businesses in the Nordics. The names that come to mind are Surgical Science, ChemoMetec, ArcticZymes, Sedana Medical, Sectra, Boule Diagnostics, and Medistim ASA. Readers might see write-ups about these companies coming when I have done the necessary research. In the meantime, I’d encourage anyone with knowledge about the companies to reach out on Twitter @PartnershipInv or by e-mail with partnershipinvestingblog@gmail.com.

Disclaimer: Always do your own research. This is not investment advice and for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blog.

Hi! Thank you! Really happy that I found your side. The funny think is that I am already invested in CHEMM nad SUS (and no I dont own that much European small cap stocks). Would appreciate if you do more and more analysis on stocks which are not on all peoples radar. I have also a focus on the health and technology sector. Nice write up on Vitec Software too.

Thanks for the write-up! Looking forward to reading about the other healthcare names mentioned. Please keep them coming!

Looked at Medistim, a fine monopoly in a growing area and not too highly valued IMO.