CSAM Health - Serial acquirer run by Outsider owner-operators

CSAM Health displays many qualities of a serial acquirer set to create shareholder value. These qualities set them up to compound the share price at 20-25% over the next years.

CSAM Health is a Norwegian company based in Oslo. The company was founded within the Oslo University Hospital and was later spun out in 2012. CSAM's strategy is to acquire specialized software in the Healthcare vertical and has applied its acquisition strategy since the spin-off.

The company went public in September 2020.

Why is CSAM Health interesting?

CSAM Health interests me for a few reasons:

- I love the serial acquirer model: It has been proven by companies in different industries that this playbook can be run well and create a lot of shareholder value. I have been looking for "the next" Constellation Software or Halma. I believe I might just have found it in CSAM Health. The nature of the Healthcare vertical is conducive to a successful inorganic growth strategy; a fragmented, large industry, incredibly low churn, the potential for high-profit margins, and cash generation.

- CSAM Health is a very focused acquirer with a clear playbook: CSAM focuses exclusively on vertical software for the Healthcare industry. This focus is key to their acquisition strategy as it involves improving margin and integrating acquisitions. I believe CSAM's industry expertise + capital allocation strategy will produce superior investment returns.

- CSAM is overlooked by institutions: With 30% of shares owned by insiders, non-existing sell-side coverage, and low trading volumes, CSAM Health is uninvestable for many institutions. This has caused the stock to be completely overlooked despite a very compelling investment case.

All-in-all, I believe CSAM Health at the current market price is a great opportunity to invest alongside an Outsider management team with skin-in-the-game.

Business overview

CSAM Health provides specialized software to the Healthcare industry. Vitec Software (VIT.B) and Constellation Software (CSU) acquire companies with specialized software for specific verticals. CSAM Health does this too but exclusively in the Healthcare vertical.

Why VMS in the first place?

As VIT.B, CSU, and Topicus (TOI) have demonstrated over a prolonged period of time, Vertical Market Software (VMS) is an incredible pond to fish in for serial acquirers. Specialized software is often deeply embedded in company workflows and the switching costs are immense. The customer base often churns just a few percent per year, providing a very predictable revenue stream.

CSAM's customers churn even less than your average VMS business, with churn below 2% a year. The Healthcare industry is even more averse to change than the average VMS customer. The Healthcare industry often has multiple systems coordinating with each other through integrations and mistakes due to poor integration or a failed migration could set a hospital back years in IT projects.

VMS businesses also require little capital to maintain organic growth. Software is often paid for upfront and software businesses have very little need for maintenance capital.

Finally, there are a very large amount of potential targets, especially as acquirers look across borders.

Existing business areas

CSAM is currently active in 7 business areas within the Healthcare vertical:

Connected Healthcare: Solutions for secure information sharing and collaboration across healthcare domains

Medical Imaging: Complete image management solution for securely capturing, storing, and sharing medical images.

Women & Children's Health: Trusted solutions to safeguard pregnancy, childbirth, and infancy.

Public Safety: Robust systems for managing every aspect of emergency response.

Medication Management: Decision support and medication management for safe and effective oncology treatments.

LIMS (Laboratory Information Management Systems: Comprehensive support for all aspects of blood, cell, and tissue management.

Health Analytics: Improving the quality, utility, and management of medical data, from its collection to analysis.

All of these business areas deliver software that is mission-critical to the customer. Here are a few examples of the type of software CSAM provides:

CSAM acquired Carmenta in the Public Safety business area. Carmenta provides software that manages Emergency dispatches (ambulance, police, fire brigade).

In LIMS, CSAM Prosang won a contract to deliver blood management system software for all Danish health regions.

The Women & Children's Health segment provides software solutions to maternity and In-Vitro Fertilization (IVF) clinics.

In Medication Management, CSAM Cytodose provides software to manage medication dosage for oncology (cancer) patients. This software enables the sharing of data between pharmacists, nurses, and physicians.

Source: CSAM Health presentation

The mission-criticality of the software solutions CSAM offers creates a business model where revenues are predictable with long contracts and price increases tied to inflation are built in contractually. This is exemplified by a churn rate below 2% per year and organic growth between 5-10%.

Acquisition strategy

CSAM's acquisition strategy is a blend of the strategies employed by different serial acquirers. If I had to compare it, I would describe it as a combination of CSU's VMS expertise and TransDigm's (TDG) turnaround/improvement strategy.

CSAM's strategy is to acquire Healthcare VMS businesses for 1.5-2x Sales and to improve margins towards their 30% EBITDA target. They call this, the Buy-Integrate-Build model. The acquired companies often start out with lower margins (<10% EBITDA margin). Through a process of professionalizing the company, CSAM improves margins within 18-24 months. Easy savings like consultants and superfluous perks are removed from the cost structure. A robust focus on cash flows and working capital is implemented, low-margin hardware businesses are discontinued and, if needed, contracts are reworked to maximize gross margins and recurring revenue. In addition to cutting costs, CSAM integrates the business by harmonizing quality controls, customer relationships, and support functions. There is almost no marketing/sales are required; healthcare providers often have contracts up to 10-15 years and CSAM focuses on adding customers through acquiring businesses instead of waiting around for a tender. The 1-2% annual churn hints that it doesn’t take a lot of convincing to renew the contract with CSAM.

Source: CSAM Health presentation

This is a very different strategy than, for example, VIT.B or Judges Scientific and more like CSU and TDG. Both VIT.B and Judges Scientific acquire already profitable businesses and change little post-acquisition. CSU is able to achieve such results because of the tremendous amount of expertise in vertical software within the organization. Likewise, TDG's expertise in the aerospace market makes them uniquely positioned to remove the bloat from an organization and improve margins.

The analogy isn’t perfect, but I feel CSAM’s strategy shares a lot of similarities with both companies. To have confidence in such a strategy, both a track record and a well-defined circle of competence need to be present. CSAM's focus on a single software vertical and the track record of successful acquisitions make me more confident that CSAM is able to pull off such integration projects and improve margins.

A data point that supports this view is that margins quickly recovered after years with acquisitions (more details under Financials & Valuation). EBITDA margins are volatile but CSAM has displayed an ability to quickly turn those businesses around and raise margins towards 25% on a consolidated basis after integration and cost cuts.

The comparison with TransDigm doesn't stop there. CSAM actively uses leverage to fund inorganic growth. With 210M NOK in Net Debt, CSAM currently has a Net Debt / EBITDA over 3x my estimate of 2022 EBITDA. If you have read my post on Learnings from Swedish serial acquirers, I mentioned a lower Net Debt / EBITDA to be a financial sign I look for.

In the case of CSAM, I do believe higher leverage can work. This is primarily because of the nature of the revenue stream. Its clients are public healthcare institutions that are as credit-worthy as it gets and the sub-2% churn rate makes this business model able to support quite a bit of leverage. Much like TDG, CSAM can and seems willing to use the growth in EBITDA to borrow more and fund very accretive acquisitions at a faster pace.

I have assumed they will consume some of their current cash balance to fund acquisitions in the next year or two and finance acquisitions with a modest amount of leverage beyond that (~2,5x Net Debt/ EBITDA).

CSAM has acquired businesses with an average size of ~20-25M NOK, though the actual size can vary. A notable exception was the large 2021 acquisition of Carmenta with sales of 83M NOK (81M SEK, Carmenta is a Swedish company and only generated slightly over 10M SEK in EBITDA, a ~12.5% EBITDA margin).

Acquisition prices are in the neighborhood of 1.5-2x Sales. This means CSAM effectively pays only about 5-6.5x EBITDA once their integration plan is done. The improvement in profitability, organic growth, and use of debt at relatively low cost work together to fuel the acquisition machine that drives inorganic growth and, ultimately, equity value creation.

Management has commented on their ambition to target larger companies (on average) and I factored this into my assumptions for future growth. The goal stated by management is to reach 1B NOK in sales by 2025. I believe this is achievable and a stepping stone to becoming a multi-billion NOK business by the end of the decade.

Growth runway

One of the keys to an inorganic growth strategy is that there are enough acquisition targets. By focusing on a specific vertical, the list of potential acquisitions is smaller than for VIT.B or CSU, which are more agnostic to the specific vertical. CSAM's focus on a specific vertical, however, provides it deep and unique insight into target businesses across geographies. CSAM indicates they have a database of about 200 businesses in the Nordics alone and are expanding this database by looking into Continental Europe. Looking at the Nordics + Europe, the total size of the revenue opportunity CSAM targets is easily more than 15x CSAM's revenue (3B NOK in Nordics alone vs ~425M revenue expected in 2022, multiples of this in Europe).

The focus of CSAM on a specific vertical gives them an advantage compared to "generalist" acquirers. CSAM management knows exactly which hospitals use what software, what software vendor is doing well and relationships with some of the vendors go back years. A Nordic seller in the Healthcare vertical will likely be aware of CSAM and have them top-of-mind when contemplating a sale.

Even experts in VMS like CSU or TOI will have trouble competing with CSAM on that front. What they need to figure out about the vertical, company, or market, CSAM already knows inside out. Don’t get me wrong, they will probably win deals and do well, but this vertical-specific expertise and the decades of relationship building in Nordic Healthcare VMS is a distinct advantage compared to even the best M&A machines out there.

Competitive advantage

Switching costs: Healthcare is an industry with high costs of failure. In addition to the high cost of failure, it is very expensive to change the software that is part of a specialized workflow. This is one of the classic reasons why VMS businesses and B2B software, in general, are attractive. CSAM's software is deeply embedded in workflows and switching away would require retraining personnel and re-integrate all existing systems to be able to communicate with each other. This makes the migration process expensive and all-around undesirable.

Management

CSAM's management team is a big reason to invest. They have multiple decades of experience within the Healthcare IT/software niche. In addition to the right background, they are as incentivized as it gets with high insider ownership.

Sverre Flatby: Flatby has been CSAM's CEO ever since it was spun out of the Oslo University Hospital, where he worked in the IT department. He has decades of experience in hospital IT/ healthcare software and is one of the architects behind CSAM's success. He owns 10% of the shares through Equilibrium AS.

Einar Bonnevie: Bonnevie is the CFO and joined the company after the spin-off in 2012. He previously ran a Hedge Fund in Norway and his financial acumen contributes to CSAM’s plan to increase shareholder value. Bonnevie owns about 10% through Equilibrium AS (Equilibrium is owned by both Flatby and Bonnevie).

Glenn Kenneth Bruun: Bruun is the CSO (Chief Strategy Officer) and was the Chief Information Officer of the Oslo University Hospital where he helped found CSAM. Bruun is responsible for implementing the integration strategy. He owns 2.34% of the shares.

Source: CSAM Health presentation

The management team collectively owns 30% of the company and the economic value of this ownership far exceeds their salaries. I believe management is well incentivized to create shareholder value and possesses the right background and track record to execute their strategy.

Bonnevie and Flatby’s sole incentive is their large share ownership. No stock options or bonuses, just salary and 10% ownership per person.

In a recent earnings call, Bonnevie stated when asked about the underperforming stock price:

“In the short run the market is a voting machine, in the long run it's a weighing machine. The laws of physics will win out in the realm of finance.”

I will discuss under Financials & Valuation why I think the market will have to properly weigh CSAM Health eventually.

Quality Score

The Quality Score rewards companies with sticky, predictable revenues, organic growth, and management ownership. On the flip side, leverage, inorganic growth, and negative cash flows are penalized.

CSAM has low churn but grows mainly inorganically. Management is very well aligned with shareholders but the company uses more leverage than might be prudent for other, less predictable businesses.

This might be a case that requires more nuanced thinking about the points distribution and rigid good/bad rules. As mentioned, the Quality Score will require refinement and the criteria for serial acquirers will be reworked later.

Despite this, I will use and publish the Quality Score based on its current scoring system (proprietary, for now) and my current assessment of the company.

The Quality Score for CSAM Health is 67.

This compares fairly well to previous entries.

CSAM is in the middle of the pack here. The main detractors for the score are the outlook for organic/inorganic growth and its approach to leverage.

Financials & Valuation

The financials for the past few years at CSAM Health have looked volatile due to the Buy-Integrate-Build strategy. The revenue growth has been lumpy and EBITDA margins have been diluted by acquisitions, recovered, and got diluted again. The key is to understand that this is part of the game for CSAM and core to their strategy.

Income Statement:

Source: FactSet and Company reports

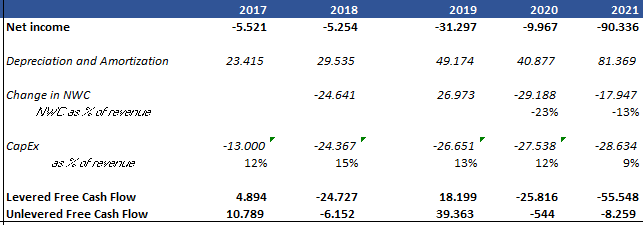

Cash Flow Statement:

Source: FactSet and Company reports

As mentioned earlier, CSAM thinks it can expand margins from acquisitions to a 30% EBITDA margin from roughly breakeven. The developments displayed above show that they are indeed able to integrate companies and improve margins. CSAM acquired a lot of companies in 2017, 2019, and again in 2021. In the year after the acquisitions, there is a clear uplift in margins, confirming that the management's strategy is indeed working. The Carmenta acquisition in February 2021 was unusually large and the margin lift will be apparent in 2023 and beyond.

In general, there are just a few key drivers once you have confidence in the integration strategy:

Organic growth: Organic growth has historically been between 8-10% according to management but the company only recently actively started reporting this number. I find it conservative to assume this gradually slows to about 4%.

Acquisition multiple: CSAM has acquired companies for 1.5-2x Sales. This multiple will inevitably go up as they acquire larger targets. For this, I assume it goes up to 2-2.5x Sales, for an average of 2.25.

Number of acquisitions: It takes a lot to scale up M&A capabilities and the pace of acquisition. In the case of CSAM, I think they will gradually scale up their acquisition pace from 3 to 6 per year at the end of the decade. This is by no means heroic as CSAM has already been able to do 2 per year.

Average size: CSAM will likely target companies larger than they historically have to achieve their stated goals. My best guess estimate of the average revenue a target will have is around 37.5M NOK, so 3.5-4M USD in revenue.

This yields the following acquisition model with the only sell-side estimate for revenue in 2022 as a starting point:

Source: Own estimates

The beige cells with blue text are explicit assumptions.

As you can see, CSAM will need to tap its 280M NOK cash balance and can use debt to grow revenues beyond what their cash flows allow them in later years.

On the cost side, I believe there is quite a bit of margin expansion possible in this VMS niche. CSAM is actively looking to control costs. Businesses that have been within CSAM for a while have margins north of 30% or have the potential to get there.

With all this being said, I come up with the following projections.

Source: Own estimates

This projection is well below management's 1B NOK goal by 2025 and below Carnegie’s estimates (Carnegie is the only firm covering CSAM Health). I think this is a realistic, even slightly conservative scenario for CSAM in the next years. At maturity, CSAM should be able to maintain margins >30% EBITDA. Even with less optimistic EBITDA margins at maturity, the investment will still work out fine at current prices.

So what would this yield in terms of returns?

Source: Own estimates

At a 20x multiple of Unlevered Free Cash Flow in 2026, the Enterprise Value would approach 2.8B NOK. Deducting the Net Debt, this leaves 2.2B in Market Cap, more than double today's Market Cap of 1B NOK. This yields a very good prospective return of around 25% depending on the time horizon and exit multiple you wish to use.

Personally, I think there is a scenario where CSAM does better than the above projections and does reach their 1B NOK in 2025 target with EBITDA margins between 15-20%. Using a decent exit multiple, this scenario would also yield a handsome return.

Conclusion

All things considered, I have taken a position in CSAM Health for about 48 NOK per share. The company's strategy and focus on a single vertical resonate with me. In addition to favorable industry characteristics, management has demonstrated an ability to improve businesses and profitability. Their ownership in the business aligns them with shareholders and both the CEO and CFO are owner-operators, with the rest of the management team also being large shareholders.

A lot of institutions are unable to build large positions and investors outside of the Nordics are unaware of CSAM Health. This provides nimble investors the opportunity to buy in at a 1B NOK market cap for a company that can grow multiples just with acquisitions in the Nordics, let alone Europe.

If I were to be wrong about CSAM, it would likely be in their ability to repeatedly integrate acquisitions and raise margins. I am comforted that they have demonstrated the ability to get this done and are true owner-operators.

CSAM Health is now part of the Partnership Investing portfolio alongside Surgical Science and Farfetch. I update investors about developments on a quarterly basis through the Quarterly Updates.

Disclaimer: Always do your own research. This is not investment advice and for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blog.

Very difficult to place a value on this kind of company, but you have done a really good job of it. Too many assumptions need to be made, which is why buying it cheap is the only thing that can really help. Price to sales right now is still very high.

Do you have an idea of what proportion of management wealth is invested. I know you said 10% through Equilibrium...but what % of this is their total wealth?

I really appreciate your analysis. This stock is hard to evaluate. For me too risky. Would you like to cover in the coming weeks Lifco, Addtech, Judges Scientific and Lgercrantz?