Keywords Studios - Serial-acquirer in the Gaming industry

KWS is consolidating outsourced service providers at a rapid pace. Its scale advantage and high barriers to entry provides it with an incredible moat resulting in a >1500% return over a decade.

Keywords Studios is a outsourced gaming services company based in the United Kingdom. The company provides services to game developers and publishers worldwide. Fueled by acquisition-led growth Keywords Studios is consolidating a fragmented, global industry with the goal to become a one-stop-shop for clients in the gaming industry.

Why is Keywords Studios interesting?

Keywords Studios has had an incredible track record of growth ever since its listing in 2013. Under CEO and main shareholder Andrew Day, KWS managed to compound revenues and earnings per share 46,5% and 40% per annum, respectively. This has led to a stellar total return of 36,75% per annum.

As you might have guessed from my industry analysis of the Gaming and Metaverse, I find the industry KWS is active in particularly interesting. The video game industry is one with a relatively short history but enough to find trends that might inform investors about the future. With gaming giants relying less and less on one-time hits or even one-time sales, the need to continuously release content changes the dynamics of how these companies choose to allocate resources. Additionally, the gaming industry is one that has grown quite steadily and has been quite resilient in the 2008 financial crisis and even the bust of the technology bubble at the start of the Millenium.

For these reasons, I find KWS's business particularly interesting and I hope the story I tell today does this justice.

Business

KWS is a market-leading provider of technical and creative solutions to the video game industry. Through its global network of service providers, KWS is able to provide a broad range of services. From game development art, marketing services, or localization services, KWS supports game developers and publishers as a vendor of outsourcing services. KWS's clients include the most reputable names in the industry such as Activision Blizzard, Electronic Arts, Square Enix, Supercell, and newcomers like Apple, Netflix, and Amazon.

KWS's service lines can be split into the following segments:

Art Services

Functional Testing

Marketing Services

Localization

Game Development

Localization Testing

Audio

Player Support

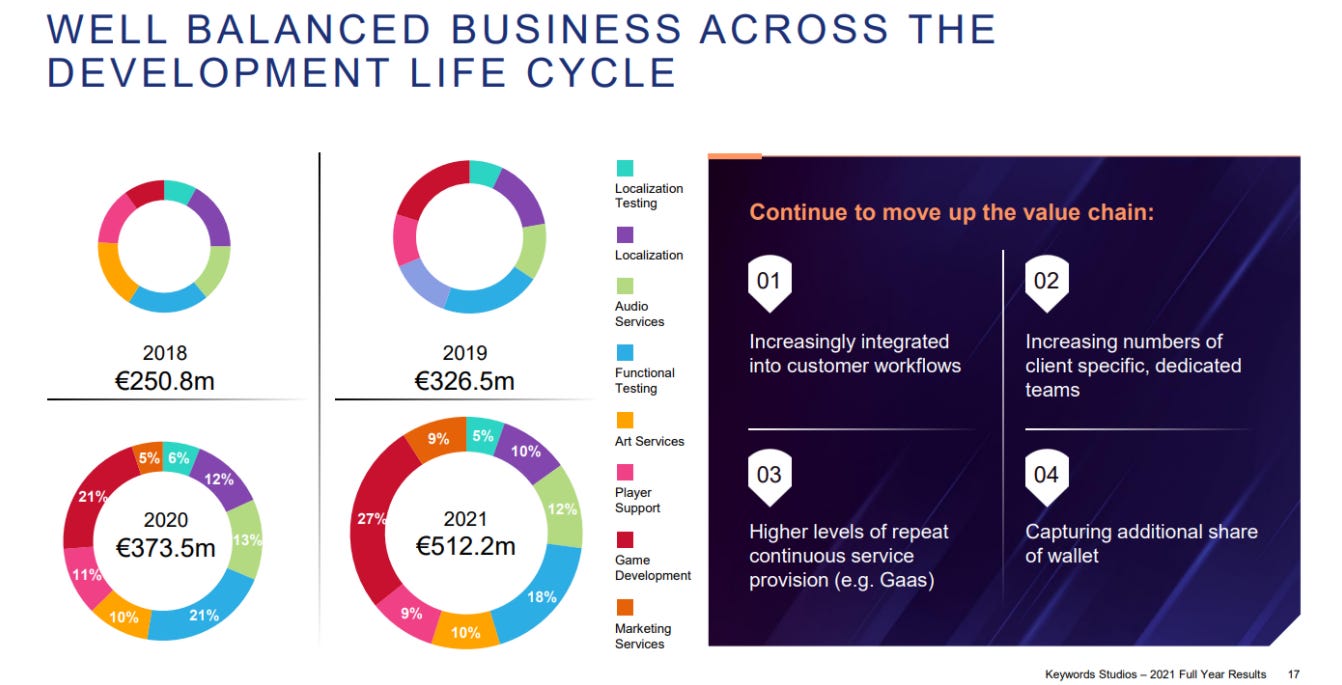

With this broad offering, KWS provides services across the entire game development cycle. This page from their Annual Report gives a decent overview of how the services fit within each stage of the development cycle:

Source: KWS Annual Report 2021

By offering various services from studios across the globe, KWS has the ability to tap into a global talent pool. Video game development and publishing is a human capital business and, much like the world of IT, it is hard to find skilled talent. Video game companies have trouble hiring at the pace needed to keep up with the demand for exciting and engaging content. This makes these companies more likely to carefully consider where to allocate their limited resources. KWS becomes a vital partner for video game companies that want to develop content but lack the resources in certain areas or would rather preserve their resources for other projects. In short, KWS helps video game companies turn fixed costs into variable costs, stay flexible on how they allocate resources from one project to another and focus on their core competencies.

Source: Company presentation

As mentioned in my industry analysis, the rise of mobile gaming and digital distribution has changed the game significantly. Gaming is now mainstream and the costs to deliver additional content have gone down. Companies like Epic Games, Activision Blizzard, and EA now focus on continuous improvement of their games and regularly add new content. This is vastly different than the old paradigm where games were developed and released once, with the vast majority of revenues coming from the first month after release. GTA V is still generating hundreds of millions in revenue almost a decade after its initial release and companies need to keep resources allocated to the development of new content in addition to new projects. Although this is a source of high-margin, recurring revenue, this stretches resources further and collaboration with external vendors like KWS alleviates some of that pressure.

Source: Company presentation

KWS estimates its Total Addressable Market (TAM) size to be $35B (ex-China). Currently, only $11B of this market is services by external services providers (KWS is the largest with €500m in revenues). The area where the most growth is anticipated is Game Development, which is roughly half of the TAM. According to research firm IDG, less than 20% of game development is done by external service providers and this number is expected to grow in the decade ahead. This explains why KWS has recently communicated its increased focus on this segment.

In addition to the video game market, KWS has opportunities to service the film and television industry as the tools used for both industries converge. You might remember how The Mandalorian uses Unreal Engine to create the background environment or how Unreal has simulated the city in the latest Matrix movie. While KWS is currently not fully committed to these adjacencies yet, this is another opportunity the company could pursue over the next decade that does not significantly divert focus.

I expect the Capital Markets Day on June 8th to give more details on the developments in the overall market and industry.

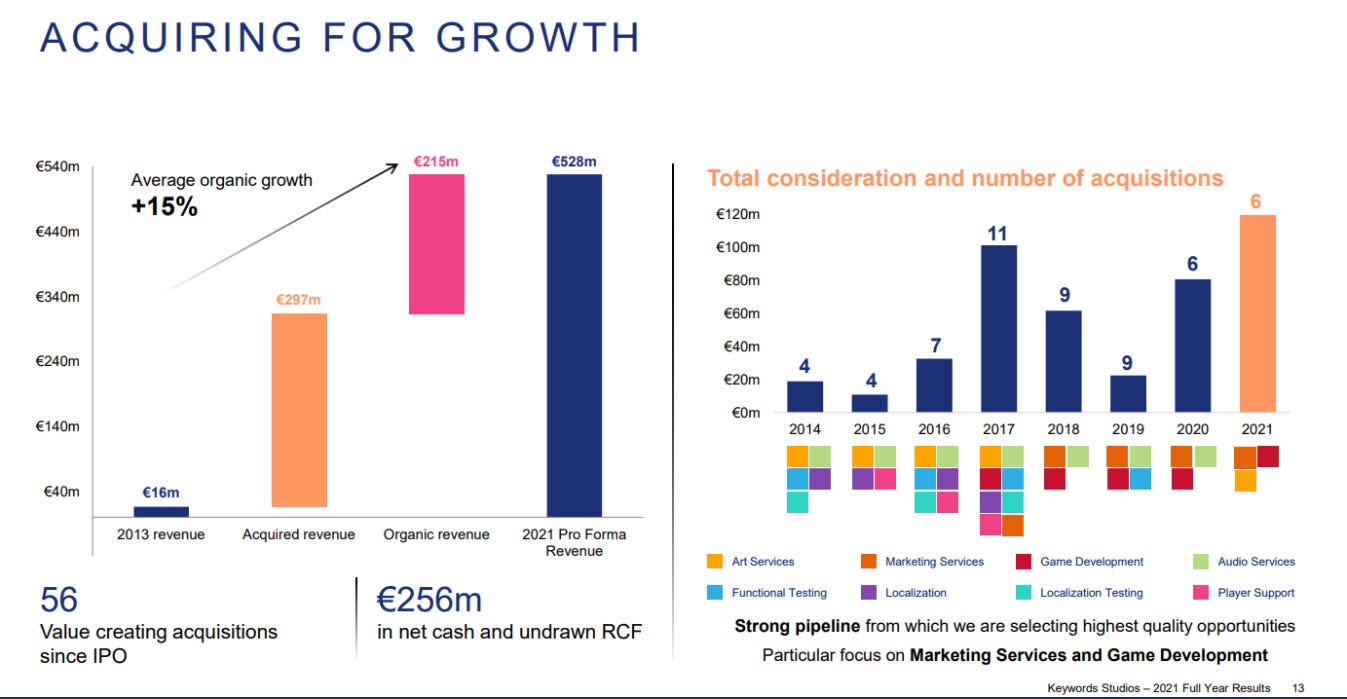

Acquisitions

KWS is undeniably a serial acquirer. Unlike many other serial-acquirer I may have discussed here or on Twitter, KWS doesn't operate a totally centralized or decentralized model, but a more hybrid model. The market for service providers to video game companies is very fragmented. This is ideal for a consolidator to acquire businesses that have existing relationships, revenues, and profits and to leverage the global scale, relationships, and expertise other companies under the KWS umbrella have. Although I have preferences for companies with a clearly decentralized or centralized model, KWS seems to be on the more centralized end of the spectrum while keeping the entrepreneurial spirit at subsidiaries alive. This is a difficult line to straddle, but KWS seems to have gotten the best out of this strategy.

Companies under the KWS umbrella refer to each other frequently, a client might request multiple services from KWS for a large project, or the same contract requires multiple studios to work on it - these are very simple examples of how KWS achieves revenue synergies and keeps its organic growth higher than the market average. This also makes KWS a perfect acquirer when someone wants to sell. Entrepreneurs selling often have the best intentions for their employees and the business as a whole. My experience following serial acquirers is that finding a buyer that can get the best out of the business is often a reason why someone would not seek to maximize the selling price. KWS often incorporates earn-outs to align incentives and their history of post-acquisition growth, and network of sellers from across the globe that can tell their experience gives KWS a distinct advantage in acquisitions.

KWS has managed to maintain an organic growth profile north of 10% in the last 5 years while acquiring businesses at multiples between 2x and 3x revenue (EBITDA margin profiles range between 10-20% depending on the business line). This results in KWS having a Free Cash Flow margin of >10% over the last 5 years. Cash flow return on invested capital has averaged 18% in the last 5 years.

With little to no debt, €100m in cash, and >€60m in Free Cash Flow to spend on acquisitions, KWS is well-positioned to continue consolidating the industry and continue its strong growth.

Competitive advantage

Scale advantage: Being a larger, global company with good cash flows provides KWS a scale advantage over other external service providers. Not only can KWS more easily allocate resources where the demand is going, but they can also spend significantly more on technology/IT tools than other, smaller vendors. This makes a huge difference in a technical industry like video games. KWS can spend significantly more to create the best tools to use internally, service customers, and gain efficiencies on their labor costs.

KWS's global presence and scale also give them an advantage in recruiting talent. With local markets experiencing different labor market conditions, being able to recruit from all over the world across many sectors of expertise is a clear advantage that sub-scale service providers and even video game companies do not have. This is something they could be leveraging better and have stated plans to lean more on this aspect.

High barriers to entry: To provide a similar offering to video game companies, a competitor would have to build a global presence across multiple service lines, something that has taken KWS a decade and hundreds of millions of euros in investment. Not only is the capital needed to achieve the same footprint and scale prohibitive, but there are also plenty of potholes along the way. Creating all these service lines internally is difficult, to say the least. Acquiring well and regularly is also incredibly hard. Maintaining an M&A machine that can do 5-7 good deals a year across the world and service lines requires a high-caliber management team, experience, and capital.

Additionally, the customer relationships that KWS has established with the major players in the industry are deep and often span years of projects, discussions, and collaboration history. These customer relationships are not easily set aside for unknown competitors that might delay the entire project if anything goes wrong.

Switching costs: KWS benefits from some switching costs which is a result of their scale relative to competitors. Large customers have difficulties switching from KWS. These difficulties stem from the lack of scale from other studios/service providers and, as a result, an inability to quickly ingest work. Smaller service providers often operate close to or at full capacity. This means that customers need a significant amount of time to migrate all their work to the smaller service providers. The workload will likely be split amongst multiple service providers, which brings additional complexities in managing the relationships. This is a hurdle customers need to clear before making the decision to switch.

Management & Ownership

This section would have been a big positive only a few years ago. Unfortunately, recent developments have made me cautious about stepping into this management situation. A bit of background:

Andrew Day, who took the company public and headed this company with all the success discussed earlier, retired early due to health problems. Even with this valid reason for stepping, I was cautious about investing without Andrew Day at the helm. In December 2021, Bertrand Bodson was appointed CEO. I am not sure what to make of this hire, to be honest. Bertrand sounds very smart and charismatic and has plenty of experience leading large organizations in the digital space (Chief Digital Officer at Novartis, CDO, and CMO at Sainsbury's, and Board member at Wolters Kluwer). But he does not have experience in Gaming, or in acquisition-driven companies.

COO Sonia Lashand Sedler recently stepped down effective immediately due to personal reasons. In this press release, it seems the company went out of its way to mention that Bodson was "well-supported" by CFO Jon Hauck. Combining all those data points, I just cannot shake this uncomfortable feeling around management.

CFO Jon Hauck has only been at KWS since 2019 and did not have any C-suite experience before joining.

Andrew Day still holds about 3% of the shares but seems to be gradually selling off his shares. Board stock ownership is trivial at best.

In summary, I am much less confident in management without Andrew Day leading the company and it is a "show me" story for Bertrand Bodson & Co for now. As I mentioned in my article on Learnings from Swedish Serial Acquirers, people are the most important thing to look for in a serial acquirer. If anything, the bar is probably higher for the management of serial acquirers. Unfortunately, I do not see any reason to be particularly confident in this management team as of today.

Financials

The business model is really not complicated. Customers request a service from KWS and KWS performs it for a price per hour or another type of unit that is about 40-50% in excess of what it costs KWS to render that service. There are overhead costs like rent, HR, finance, etc. that need to be covered. The contracts can be adjusted periodically or on a project-to-project basis, depending on the service. This results in a Gross margin between 30-35% and an EBITDA margin of around 15%.

Keywords Studios has a great track record of growth, profitability, and cash generation. The company has grown its revenues at a 40% CAGR over the last 5 years with EBITDA margins consistently in the 14-16% range. Free Cash Flow margins have hovered around ~10% quite consistently as well and FCF has been higher than Net Income every year. Even with Equity offerings for a total of ~7% annual dilution along the way, FCF per share has compounded at 33% per annum over the last 5 years.

Organic revenue growth has also been strong, with the gaming outsourcing industry growing faster than the Gaming market at large. Organic growth has been higher than >10% for a long time and is projected to stay strong over the next years.

Source: Company presentation

In short, this is a cash-generating company with a great track record of growth. Not only has the growth been strong, but the company has also managed to add complementary, yet diversifying verticals to their offering and can now offer a complete solution to any gaming company in the world.

Source: Company presentation

Keywords Studios' historical financial performance is worth praising and the tailwinds behind this success will stay present for the foreseeable future. The key question to me as an investor is: Is the current management team able to keep this going for another decade?

Valuation

KWS is currently valued at an Enterprise Value of 1.8B GBP and 23.5 GBP a share. With about € 60m in Free Cash Flow, which translates to ~50m GBP, the 36x FCF valuation implies significant growth in the next few years. Just as a thought exercise, imagine that KWS trades at 15x or 20x FCF in 5 years’ time. This might be reasonable, or it might not be, but I think it is a decent starting point.

With this exit multiple ranges, KWS would have to compound FCF at 23.5%-31% a year just to achieve a 10% return. This excludes any dilution and, as we have seen, this was a 7% drag over the last 5 years. Dilution is something I have either ignored or underweighted for too long and recent market developments have made sure of reminding me of this.

Putting it like this, I think the current price reflects ample optimism and I am cautious about underwriting these growth rates for a 10% return. This is especially the case as I feel less confident in the current management team than I felt about the previous one.

Conclusion

Keywords Studios has a lot going for them on a fundamental and industry level. The tailwinds in Gaming are real and the trend within the industry towards outsourcing makes KWS' sub-industry grow even faster. KWS has a superior positioning in its industry with stellar organic growth, a successful acquisition track record, and the opportunity to keep consolidating a fragmented industry. This alone makes KWS worth studying and keeping an eye on.

Recent management developments and the current valuation, however, make the company only deserving of a watchlist spot. I hope that the upcoming Capital Markets Day on June 8th will provide more details on how the new CEO intends to grow the business and that the company show it can continue its impressive track record. When I am fully convinced of this and the stock is at the right price, I will seriously consider KWS as a part of my portfolio.

Hi, terrific job you did with all your thesis. I've just discovered you (I started learning about investing short ago). Thanks for sharing your deep research for free.

You might want to analyze RWS Holdings. Similar business (translation, linguistic services), based in UK, also an acquirer, but more diversified areas (outside gaming), cheaper valuation (IMHO, but I am not still good at that).

I am a freelance translator and I've worked for both of them. I know the business from inside and neural machine translation is gonna be a game-changer (lower rates for us freelancers, probably higher profits for these agencies).

Kind Regards,

Great article, insightful! On the TAM would be great to know the breakdown by contient? SEA and LATAM sems to be the fastest growing regions (given the number of app downloads and active user etc) whereas KS focus is on Europe and US. Is this a future headwind for KS?