Medistim - A dominant force in its Medical Devices niche

Delivering a 33% p.a. total return over the last decade, Medistim has been a successful European compounder by dominating its niche. I will explore if it still has its best days ahead of it.

Medistim is a Norwegian medical device company based in Oslo. The company sells medical devices used during cardiac and vascular surgeries and is a market leader in its niche.

Medistim went public in 2004.

Why is Medistim interesting?

The historical performances of Medistim are enough to make any quality-oriented investor interested. The company has consistently grown its intrisic value by growing cash flows and hardly issuing any shares.

On further inspection, it turns out Medistim is a quasi-monopoly in a niche they effectively created. In just over two decades, Medistim has taken the penetration of its measuring devices from 0% to 50% in cardiac surgery. If this wasn't impressive enough, they have launched additional products that extends their reach into natural adjacencies.

Medistim's products do not benefit from the exciting, high-growth tailwinds present in ArcticZymes', ChemoMetec's or Surgical Sciences's end-markets. Instead, it is a story of a company that continues to slowly but surely expand in their core market and use their industry recognition to conservatively branche out into adjacencies. In this regard, Medistim is more similar to CellaVision than to the other Nordic Medtech companies I have covered.

Business

Products

Medistim provides medical devices to the Healthcare sector, more specifically cardiac surgeons. Medistim's flagship product, the MiraQ uses transit time flow measurement (TTFM) to give surgeons real-time information on a patient's bloodflow after a coronary artery bypass graft (CABG). First, let me explain those terms:

Coronary artery bypass graft (CABG) - a surgical procedure to restore normal bloodflow to an obstructed coronary artery.

Transit time flow measurement (TTFM) - a measurement tool to assess the quality of bloodflow after a graft.

Put simply, the MiraQ provides information to a surgeon to make sure the graft went well and no mistakes have been made by measuring the patient's blood flow. This was traditionally done with palpation (feeling with your hands/fingers, how analytical!) and is still today the dominant practice. Medistim's Flow measurement is globally recognized as standard-of-care, with Germany, Scandinavian countries, and Japan using Medistim's products in 70-90% of CABG surgeries. I will discuss market penetration in depth later.

The MiraQ Cardiac

In addition to Flow measurement, the MiraQ offers surgeons ultrasound imaging tools to have a 3D view. This further reduces errors as scans do not provide exact 3D information to surgeons ahead of surgery. Medistim has offered the Imaging capability since 2010 and is currently the only company with both Flow and Imaging capabilities.

In addition to these systems, Medistim sells consumable probes for both Flow and Imaging. These probes can be used 50 times for Flow and 100 times for Imaging. Medistim's business model is thus the well-known razor/razorblade model employed by many other medical device companies.

Medistim's products are the most studied and are endorsed by the European Society of Cardiology (ECS), the European Association for Cardio-Thoracic Surgery (EACTS), and The British National Institute for Health and Clinical Excellence (NICE). In 2020, the company performed a study (the REQUEST study) about the use of both Imaging and Flow during CABG procedures. This study provides more recognition and data to help drive the adoption of Imaging in addition to Flow.

Finally, Medistim owns a small distributor business that operates in Norway and Denmark. Medistim originally was only a distributor before they developed their own products in the 1990s. The distributor business has had lackluster growth and is now very small compared to the company's own products. This has benefited the company on the bottom line as Medistim earns Gross Margins of around 85% on its own products and just over 40% in its distributor business.

Source: Company reports

Own products have grown from 67% of revenue in 2013 to 80% of revenue in 2021. With that revenue split developing in favor of higher margin revenues, Gross margins have expanded from 70% to 77% over the same period.

I personally had trouble understanding why Medistim still owned this business. However, after some conversations, it turns out group management spends very little managing the distributor business and it is a steady source of cash flows with almost no drain on attention or resources. Divesting this business might be something worth doing if the company intends to reinvest the proceeds in initiatives with higher returns. More on this when we get to Management & Ownership and Financials & Valuation.

Markets and opportunities

Medistim's largest markets are the US and Germany. Medistim sells directly in the US, Germany, the United Kingdom, Spain, Denmark, and Norway. Other markets are serviced through a network of distributors.

While the penetration of Medistim's products is high in European countries, with 80% penetration in Germany and over 70% in the Nordics, US penetration is still less than half that. Japan is 90% penetrated by Medistim products.

Medistim is globally 35% penetrated in global CABG procedures. The majority of the CABG procedures are not using any measuring equipment. Within the procedures using equipment, Medistim has over 85% market share with the rest going to long-time competitor Transonic.

Source: Company reports

The US is the largest market for healthcare in general, and Medistim's niche is no different. Around 30% of the world's 700.000 CABG procedures are performed in the US, or around 200.000 procedures a year. The global CABG market is estimated to be around 1B NOK.

Because of structural issues, the US is more difficult and slow to penetrate. Each surgeon and hospital make its own purchasing decisions, compared to more centralized procurement in other markets. This makes the most lucrative market a difficult nut to crack for Medistim. Despite these structural challenges, Medistim has managed to grow at a healthy rate in the US, doubling its market share from 13% to 25% in the last decade.

Source: Company reports

There is a quick sidenote that I need to mention about the US market. To reduce the barriers to adoption, Medistim places the equipment for free and a Pay-as-you-Go leasing model where hospitals pay a fee for each procedure that includes the system and probes. This is unique to the US, other countries sell the equipment upfront and the probes as they are ordered. Medistim still offers to sell its systems and probes as it does outside of the US, but the Pay-as-you-Go model is where 50-60% of US revenues come from.

The amount of procedures charged through this model is referred to as US procedures sold. This number has more than doubled in less than a decade.

Source: Company reports

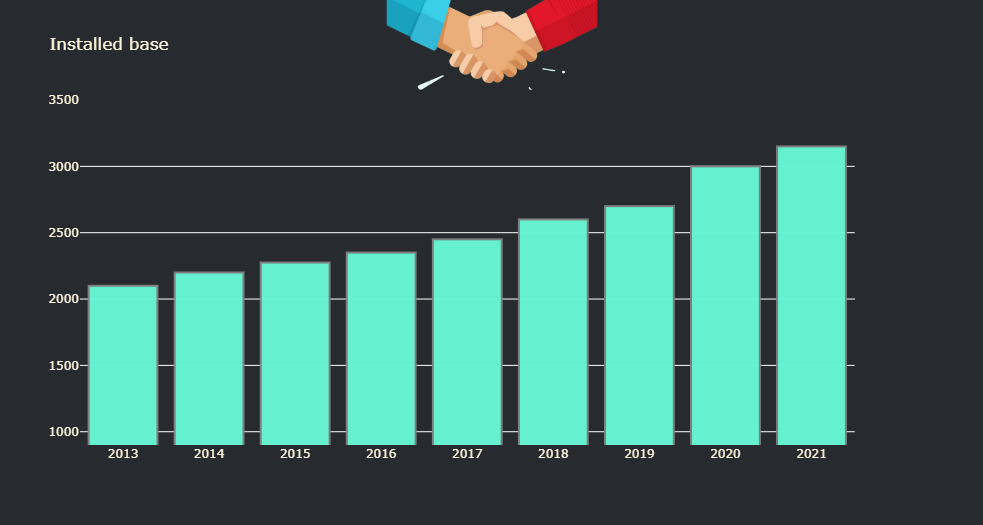

These developments clearly show that Medistim has been able to expand the reach and use of its products. The installed base, a key indicator for the razor/razorblade business model, has grown around 50% in the same period.

Source: Company reports

Besides CABG procedures, Medistim offers a modified version of the MiraQ for Vascular procedures. The products were always suited for Vascular procedures, but Medistim only recently pushed the message that its products could also be used for them. The market penetration in Vascular, for which the Imaging capabilities are particularly well-suited, is just around 5% for a total market opportunity of an additional 1B NOK.

To conclude the Business segment of this post, I will try to lay out what I think are Medistim's opportunities to create value:

Continued adoption in the US: Obviously, Medistim should strive to get its market penetration in the US towards the levels found in the Nordics and Germany. This alone would enable Medistim to 2-3x their revenue in the US, which is already 35% of total revenue. Is 50-60% penetration by 2030 possible?

Converting Flow-only to Flow + Imaging: By converting its customers from Flow-only users to Flow + Imaging users, Medistim can increase its revenue per procedure significantly and increase switching costs. The REQUEST study is the first step towards this goal.

Increase market share in Vascular surgeries: While Medistim is the standard in Cardiac surgeries, increased adoption in Vascular surgery presents the opportunity to double the size of its Total Addressable Market compared to just CABG. This is already underway, with around 5% penetration and fast growth in Vascular.

Increase direct market presence: Medistim has a direct presence only in its largest markets. By selling directly in additional markets, Medistim could take the margin that is currently going to distributors. This has to be done thoughtfully and I wouldn't pretend to know the nuances of keeping all stakeholders satisfied. However, it is clear that selling directly will come with better economics.

While no formal steps have been taken, the company has indicated being interested in gaining a foothold in the fast-growing Chinese and Indian markets. These could be the next growth markets once the US reaches a certain level of market penetration. I think those are markets worth having a direct sales presence in as they are still early in their maturity.

What is encouraging is that Medistim has demonstrated the ability to create its own market as a quasi-monopolist and gain ground in developed markets. The next decade does not rely on Medistim coming up with the next great product but on selling more of the products they already have and doing more of what they have already been doing for the past decade.

To execute on these initiatives, Medistim will need to invest, whether it is in sales or in efforts to gain more recognition through studies, Key Opinion Leaders, journal publications, etc. (which is a form of sales).

Competitive advantage

Switching costs: Like most companies in the Medtech space, Medistim benefits from high switching costs. Once a surgeon is trained on a certain system, they become reluctant to change. The high cost of failure of medical devices simply weighs heavier than the potential improvements a marginally better system might bring.

High barriers to entry: Medical devices are heavily regulated and medical professionals are particularly careful before experimenting with new technology. A new competitor would have to get its device approved and produce enough data to convince medical professionals about the product. As Medistim has experienced, this can be particularly difficult. The road is long and even a better product requires both capital and good execution before reaching a viable installed base.

In addition to this, the initial investment means that buyers are particularly keen on using a system as much as possible, causing replacement cycles to be longer. It would thus take a significant amount of time for a competitor to displace a large portion of Medistim's installed base.

The high barriers to entry and switching costs are especially powerful when you consider the total size of Medistim's TAM. Medistim estimates its TAM to be 4B NOK in total, or just over $400M. While this provides a good growth opportunity for a company with Medistim's size, the TAM is far too small for larger Medtech companies like Medtronic or J&J to really be interested in. If anything, they would likely prefer to buy Medistim to enter the market instead.

Management & Ownership

Medistim'sleadership has both positives and negatives, although I lean more towards the positive side after some time to research.

The company is led by CEO Kari Hogstad and CFO Thomas Jakobsen. Both have been with the company for a significant amount of time and have thus been directly responsible for the great execution we discussed earlier. The management team does not own what I'd describe as a "significant amount" of shares. They are very much professional managers who are incentivized through modest bonuses and equity incentive plans. A significant portion of their annual compensation can be earned through long-term equity incentives. Medistim finances share purchases at the market price as a loan. Management thus only makes money from the shares if they appreciate beyond the market price at the time of purchase.

Despite not being owner-operators, the tenure and track record of the management team as well as conversations I have had convince me that they are the right people to lead this company.

Instead of an owner-operator at the management level, Medistim instead has strong long-term shareholders on the Board. This very much compensates for the relative lack of shareholdings compared to companies I have discussed and is something often found in well-run European companies.

The largest shareholder with 10% of the shares, Aeternum Capital, has two representatives on the Board and has a long-term active shareholder mindset. This is positive, especially because I have some question marks around capital allocation.

The second largest shareholder is Øyvin Brøymer. Brøymer has been a large Medistim shareholder for more than two decades and Chair of the Board since 2000. He still owns around 7% of the outstanding shares in the company.

Both Aeternum Capital and Brøymer are on the remuneration committee.

I am overwhelmingly positive about Medistim's Management and Ownership. However, I am of the opinion that a company with Medistim's growth potential should not be paying such a high dividend. The reinvestment opportunities are plenty and should yield attractive returns. I think that Medistim would create more shareholder value by returning less to shareholders through dividends and reinvesting those funds into growth initiatives in the US or other growth markets like China or India. Funds could also be acquired by selling the distributor business. I doubt any investor is interested in Medistim because of their distributor business and a lump sum of cash to invest in expanding the sales teams could create a good amount of value, though not enough to really press the issue.

Time will tell if the Board and management team agree with this. A change in capital allocation policy would change the growth assumptions I would be willing to make and thus the valuation. After all, a few percentage points difference in revenue growth when this revenue has ~85% Gross Margins makes a large difference to the bottom-line over 5-10 years.

Quality Score

Medistim's Quality Score benefits from a high-quality base business model with recurring revenues, a strong competitive advantage, and a track record of good profitability. However, the relative lack of ownership (compared to owner-operator-run companies) and what I think is the sub-optimal capital allocation is the difference between a good and very good quality score.

As currently set up, the Quality Score doesn't give credit to the stable and aligned shareholders on the Board. This is surely a shortcoming of this score. Perhaps the strong shareholder base could add a few points but it will not add any points with the current scoring system.

Medistim's Quality Score is 68.

Medistim compares well to previous entries, especially as they could change their capital allocation policy. This would result in a much better score.

I would reconsider the Quality Score for Medistim if they were more focused on reinvesting in growth. In the meantime, the score is good and mostly reflects the company's strong market position and the quality of its core business.

Financials

Medistim has an attractive financial profile, with Gross Margins approaching 80% and EBIT margins >25%. In addition to good accounting profitability, the company has low capital requirements and outstanding cash conversion metrics. Here is a snapshot of the past 4 years:

Source: Company reports & FactSet

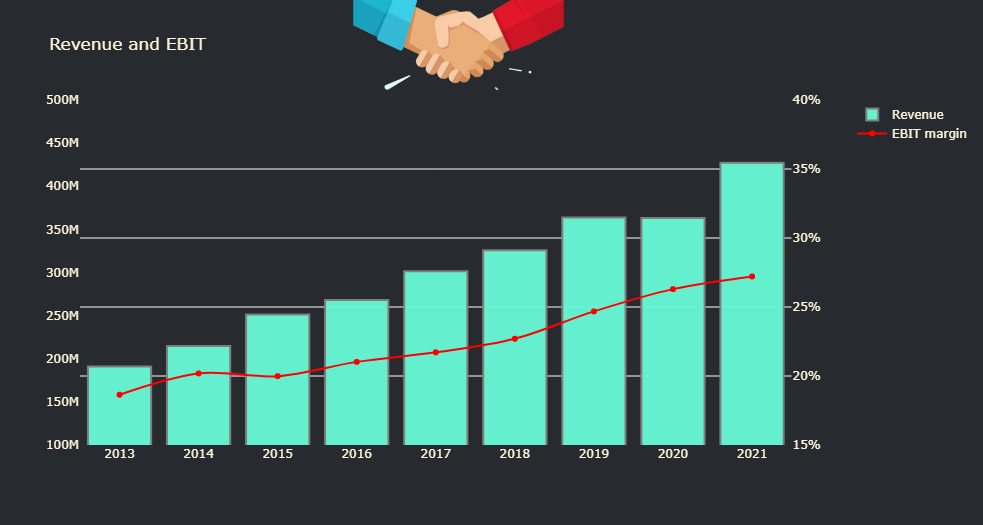

On a longer timeframe, the conclusion is similar. Medistim has grown revenue at a healthy rate and continuously improved EBIT margins.

Source: Company reports & FactSet

Since 2013, EBIT margins have improved from around 18.5% to 28.5%. This is due to the increased proportion of higher revenues from its own products and operating leverage.

Going forward, I think Medistim could keep growing revenues >10% for a few years. This would require increased investment in growth and exercising some pricing power. Beyond that, I hope Medistim is able to keep this up but doing so would require a bit more investment than I believe they are willing to make as of right now. I also think Medistim could deliver upside on the Gross Margins by expanding the markets with direct sales coverage and marginally lower production costs. I think this is doable and they are capable of pulling it off, but I am not assuming any GM expansion for my projections.

The projections I come to look like this:

Source: Own estimates

With a modest exit multiple, this would give us the following result.

Source: Own estimates

I think this is an achievable base case. Unfortunately, this would not yield a return I'd consider attractive enough. Even with some dividends along the way, the returns are not as attractive as the opportunities I usually look for.

With more investment, some Gross Margin improvement, and faster revenue growth, Medistim could realistically achieve better EBIT margins in the long term. As the past decade has demonstrated, there is quite some operating leverage in the Own Products segment. 40% EBIT margins are not uncommon for niche but dominant Medtech businesses with Gross Margins ~90%.

My estimates and valuation could change if Medistim is able to deliver on the opportunities I discussed and investment in growth is reprioritized above dividends. I may have overestimated revenue growth in the short-term or underestimated margins but at the current moment, this is a projection that serves as a decent baseline.

Conclusion

Medistim is a company where there is a lot to like. A strong market position in a market with lots of greenfield opportunities, a strong ownership base, and a track record of profitable growth. Medistim has largely created its own niche and absolutely dominated it for two decades. There is no reason to believe this will end soon, though the growth rates have naturally slowed down.

Despite some questions around capital allocation, I think Medistim is a very interesting business for quality investors to keep on their list. At the right price, Medistim is a company that I would feel comfortable owning.

Unfortunately, the market seems to be willing to pay more than me. This might change and Medistim will be on my watchlist in the meantime. I will be looking out for changes in capital allocation, margin development, and the rate at which Medistim gains ground in the US to reassess my projections.

I very agree with your conclusions, I see it as a possible portfolio guardian at the appropriate multiples and waiting a possible expansion at other markets.

If I look at the employee split, they have 1/4 of total people in the US...mostly sales.

How can they possibly be more agressive in that area?