Pushpay (PPH.ASX / PPH.NZ) - An under the radar growth technology company

We add Pushpay, a compounding software/fintech provider to the faith sector, to the Partnership Investing portfolio. Subscribe to the newsletter to stay updated.

Pushpay is a New-Zealand based company that is mainly active in the United States. The company provides donation processing services and software solutions to the faith sector in the US. Pushpay was founded in 2011.

Investment summary

We believe Pushpay’s dominant position in the US faith sector niche and long growth runway gives investors a compelling investment opportunity at today’s prices. Pushpay has expanded the breadth of its software solutions and has the opportunity to become a mission-critical software provider to US churches. Growth opportunities in its current niche and potential expansion into other verticals and geographies give us reason to believe Pushpay could grow significantly in the next five to ten years. Based on the growth opportunities, we believe Pushpay shares are currently undervalued and could deliver ~20% IRR over the next five years.

Business overview

Although Pushpay is based in New Zealand, 97% of its revenues come from the United States. The company provides donation solutions. The solutions used by Pushpay customers can be split into 3 categories:

Engagement solutions

Management solutions

Donations solutions

The engagement solutions are, for example, custom mobile apps the churches can use to stay in touch with their congregation. These solutions are used by churches to retain their churchgoers and to inform them about upcoming events and developments as well as monitoring the congregations’ engagement metrics.

The management solutions have recently been added to Pushpay’s product offering through the acquisition of Church Community Builder (CCB), a church management software (ChMS) company. Since the merger, the Pushpay and CCB team have built a new solution, ChurchStaq. Churches, due to their particular profile, often need more specialized management software than larger players can provide. This is where CCB provides a product that is custom-made for churches’ needs with a Software-as-a-Service (SaaS) model.

The donation solutions enable churches to receive digital donations. Pushpay receives a 2% processing fee for processing the donation. This is where Pushpay started its business and has found broad adoption. Churches need a lot of help and specific sorts of account management, which potential competitors like Square or PayPal are not able or willing to provide to this market. Pushpay’s processing fee currently is the main source of revenues.

Pushpay currently processes about US$6 billion in volume. The total amount of donations to churches is estimated at $150 billion, of which only about 15% is digital. Pushpay indicates their churches receive about 45% of their donations digitally, with some more mature church clients around 60% of donations. Givers also seem to adopt this method of donation very easily. People who donate digitally tend to donate at least 20% more than non-digital donors. At their Investor Day 2020, the company shared analytics of their adoption curve, after someone donates digitally for the third time, they tend not to go back to cash or cheques. This has been a source of tremendous growth, especially during the COVID-19 crisis where churches urged their members to donate digitally instead of physically delivering cheques or cash to the church. Being forced to donate digitally makes people full digital donors just after their third digital donation, and this will most likely be a permanent change after the pandemic. This is a great indicator of the importance of Pushpay’s product to their church clients and the development of these metrics is something to keep an eye on in future periods.

Pushpay currently has about 11.000 customers and its average revenue per customer (ARPC) is $1317 a month as of its 2020 annual report.

With the $85 million acquisition of CCB in 2019, Pushpay has taken an important step towards becoming a mission-critical software vendor to its client base. The CCB management software connects seamlessly with the Pushpay donating solution and has multiple integrations with other vendors churches might use. The ChurchStaq software offering was launched in September 2020 and combines the CCB offering with the rest of the Pushpay product portfolio, integrating the management, engagement, and donations solutions.

With some background information on the company’s market and product offering, we can take a look at Pushpay’s growth runway.

(Source: Company presentation)

What is Pushpay’s growth opportunity?

The annual church donations, Pushpay’s largest source of revenue, are estimated at $150bn. As mentioned earlier, the adoption rate for digital donation is still relatively low. Pushpay only processes about 3-4% of yearly donations despite being the largest digital donations processor by far. Further adoption of digital donations is an obvious source of potential growth in the next few years. Pushpay also might expand its market on its own. The adoption metrics shared by the management indicate that church members tend to give 20% more than non-digital givers. This is both a reason for churches to adopt Pushpay’s products as it is a growth driver on its own.

Pushpay still has to service most of the Catholic churches in the US. The company is currently mainly servicing Protestant churches. The Protestant Christians are the biggest group in the United States. Roughly 48.9% of Americans are Protestant and 23.0% are Catholic. The Protestant church structure is decentralized, each church making its own decisions. This makes it somewhat easier to onboard such churches as there is little to no bureaucracy and decisions are made on a local level. The Catholic structure, however, is much more centralized, with religious leaders overseeing a certain region. The purchasing decision is therefore made higher up. Pushpay would have to convince the regional leaders to implement their solutions and this would happen at multiple churches at once. This is still a promising growth opportunity as Catholic churches are underpenetrated by Pushpay. Solutions tailor-made for Catholic churches could also expand Pushpay’s possibilities internationally. Spanish, Catholic products could be rolled out on the entire Spanish-speaking world, where people are very committed to their religion. The Latin American market could provide an additional source of growth in the mid-to long-term.

(Source: Company presentation)

With the acquisition of CCB and its broader product offering, Pushpay is in a position to become churches’ key vendor. The new ChurchStaq ChMS product is an opportunity for Pushpay to be the mission-critical vendor for churches like Enterprise Resource Planning (ERP) software to corporate clients. This is a good opportunity to increase ARPC

With a longer-term view (5 to 7 years out), Pushpay could expand into other verticals. Non-profit donations, tuition processing, and alumni donations to schools are examples management has alluded to in the past. However, at the present moment, Pushpay is dedicated to dominating the US church market. The secular tailwinds towards digital giving and the size of the market are enough reasons to keep its eye on the ball to fully capture this opportunity. We already liked the length of Pushpay’s runway in its current market but the additional optionality gives us much reason to believe they could grow even longer.

Competitive advantages

Switching costs

Pushpay’s solutions are, once implemented, vital to the church’s day-to-day operations. They need a reliable way to receive and process donations, manage their congregation, and communicate with their members. We especially like the CCB acquisition and the company’s intention to become a key software vendor. The new ChurchStaq suite is meant to become the spine of a church’s operations. With this product expansion, Pushpay can become a one-stop-shop for software solutions to churches. The ChMS integration with donations and engagement solutions makes Pushpay’s products even more essential to their customers. Once implemented, it will be increasingly difficult to switch without incurring significant switching costs.

Scale advantage

This might seem counter-intuitive at first glance but bear with me. Yes, PayPal, Square, Adyen, etc. might be larger and have more scale than Pushpay. But Pushpay is the largest player in a specific niche market, the US faith sector. These large Fintech players have much more scale than Pushpay but target the larger mainstream commercial market. Churches have very specific needs, these companies will not bother to try to fulfill those needs due to the smaller market size. The $150bn yearly donations are peanuts compared to the volumes large and shiny Fintech players are focused on.

Pushpay’s main competitors are small startups with not much funding. Tithe.ly, one of the most well-known competitors, has about $50mn in revenues and has received just $20mn in funding since 2015 according to Crunchbase with $15mn in the latest round back in 2019. To put this into context, Pushpay spends >$15mn in Research and Development in a single year. Subsplash, another competitor, has, according to different sources, about $20-$30mn in revenue, or about a fifth of Pushpay. Most of Pushpay’s competitors offer ChMS software or donations processing, not both. Tithe.ly does offer both ChMS and donations processing, although their solutions seem to cater more to the smaller churches in this market.

A competitor entering this niche to displace Pushpay would have to build all the solutions Pushpay offers, including the essential integration with third-party vendors (accounting software, billing software, etc.). The new entrant would then have to deploy a salesforce to convince the ~11.000 Pushpay customers to switch. This would take a tremendous amount of time and resources. In the meantime, Pushpay has reached profitability and can keep spending on R&D to improve its current market-leading products and has an established reputation in this niche. The few companies that have the resources and the patience to start such an undertaking are likely focused on much larger markets where there are more greenfield opportunities.

In short, we think Pushpay’s position as a behemoth in a niche market is a source of competitive advantage.

Management and Ownership

A key to assessing a company’s ability to grow its business successfully is properly evaluating management and key shareholders. This is the area where we feel somewhat less confident about Pushpay. There has been some turnover at the top of the leadership. The company’s founder Chris Heaslip left in 2019. The then-Chairman of the Board Bruce Gordon took over as CEO. Gordon transitioned the company into profitability before leaving himself at the end of last year. Pushpay named Molly Matthews, the Chief Customer Officer, as the new CEO. Matthews has been at the company since 2016 and quickly rose through the ranks in the customer-facing part of Pushpay. Despite Matthews’ lack of experience as a C-suite executive, it is encouraging to see Pushpay promoting a customer-oriented person to CEO. Matthews is also Pushpay’s first American CEO, something we will come back on later.

Two shareholders, who also held Board seats, had a chequered past that might have impacted the market’s perception of Pushpay’s governance. Fortunately, the persons recently resigned from the Board and have since then sold their 15% stake to Sixth Street, a growth and tech-oriented US asset manager. They made a large investment in other Tech and FinTech companies, the most recognizable names being Spotify and Airbnb. Sixth Street bought the entire 15% stake at a 5% premium. Other reputable small-cap funds in the US and Canada have recently bought serious stakes in Pushpay. We see this as a positive development that might turn around the market’s perception of the company.

It is encouraging to see an “Americanization” at Pushpay. The company always has derived all its revenues from the US but the leadership was mostly from New Zealand. The appointment of an American and US-based CEO, the entry of Sixth Street as a key shareholder are interesting developments to expose Pushpay to the US investor base. Pushpay is essentially a mostly US company, but without a local listing, it falls outside of the spotlight for many US investors. With a dual-listing in New Zealand and Australia, it would be very logical for Pushpay to seek a listing in the US.

Financials and valuation

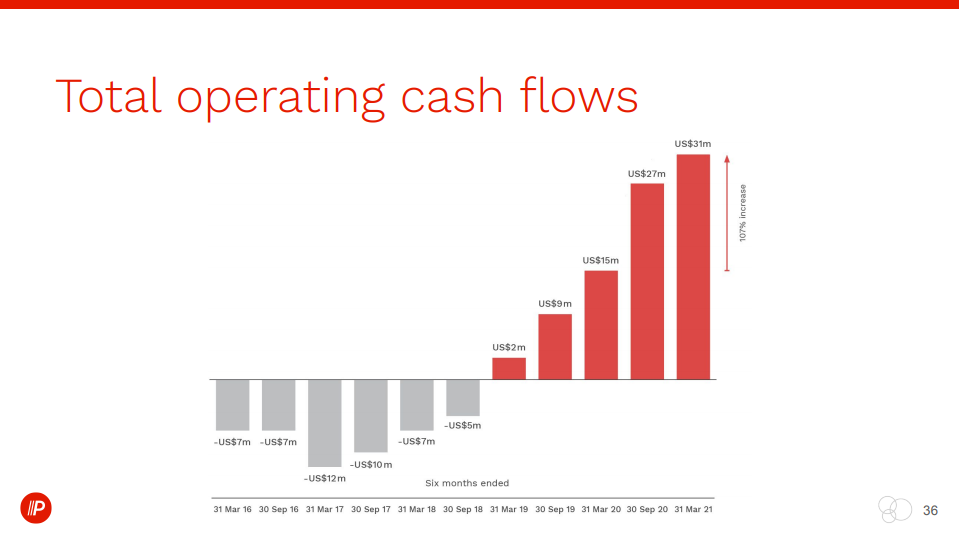

Unlike many fast-growing tech companies, Pushpay is already cash-flow positive, excluding their acquisition of Community Church Builder. Pushpay had $179 mn in revenue at the end of FY2021 (ended in March 2021) and EBITDAF (Earnings before Tax, Depreciation, Amortisation and Foreign currency) of $59mn, compared to $125mn in revenues and $25mn in EBITDAF the previous year. Although we dislike alternative metrics to earnings or cash flows, EBITDAF should approximate pre-tax cash earnings. Pushpay is a digital company and does not need to replace many physical assets. The foreign currency adjustment is because 97% of their revenue is in US $ and they report in US $, the foreign currency fluctuation is attributable to the other 3% and a part of their cost base is in NZ $ (much of their R&D team is located in NZ). It is clear that Pushpay has gained scale and has now crossed the point at which they show true profitability.

(Source: Company presentation)

Their processing costs have gone down as a percentage of revenue due to their scale. Gross margins have gone from 57% to 68% within 4 years. Although I do not foresee the gross margins common for other SaaS businesses (~85% gross margins), further gross margin expansion should be attainable in the coming years. Pushpay has had great success in acquiring customers efficiently. Sales and Marketing costs have not increased much compared to revenues.

The company has just reported $59mn in EBITDAF. Pushpay is currently valued at $1.3bn (we will value the company and the stock in US $ for simplicity’s sake), or ~22 times this year’s EBITDAF of $59mn.

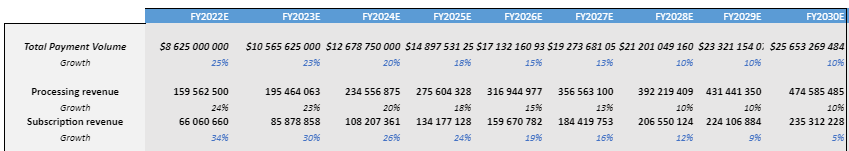

We created a model where the main inputs were the growth in processing volume and growth in software revenue. We had to guess to what extent the company could benefit from operating leverage after reaching this inflection point in profitability.

We expect Pushpay will be able to grow significantly in the next 5 years. The competitive advantages outlined earlier give us confidence that Pushpay can sustain a high level of growth as well as high returns on invested capital for the foreseeable future. We expect Pushpay’s processing volume to reach $16bn in 2026. Assuming the $150bn in yearly donations grows at 3% a year until then, Pushpay would process about 9 or 10% of the $173bn in donations. This would happen through a mix of acquiring new customers, increased adoption by church members, and due to increased giving from digital givers compared to non-digital givers. The increased processing volumes would give Pushpay $316mn in processing revenue in 2026, a 15% CAGR.

Pushpay’s software solutions give the company a great opportunity to cross-sell its products and fulfill more of the churches’ needs. Pushpay’s software revenue was just $32mn in FY2020 and has grown to $49mn in FY2021. We think the broader ChurchStaq offering as well as the integration of Pushpay’s products into CCB’s offering gives the company a chance to become a true SaaS business in addition to its donations processing solutions. We think Pushpay can grow its software revenues at a 26,5% CAGR until 2026. This is a significant growth rate, but it's still lower than the growth rate >32% in the last few years. Pushpay’s software revenue would reach ~$159mn in 2026 with those expectations.

This would take Pushpay’s 2026 revenue estimates to $475mn, a ~20% CAGR from the FY2021 result.

(Source: own estimates)

We think that on $475mn in revenues, with the operating leverage the business has, Pushpay can realistically reach $130mn in Free Cash Flow.

To value Pushpay, we used a Discounted Cash Flow Valuation and Exit multiple valuation.

The discount rate was 10% and the terminal growth rate 2%. Our DCF valuation yielded a $1.65bn enterprise value, or $1,47 US a share. This implies some undervaluation when compared to the current price of $1,18 US. Keep in mind that DCF valuations are very sensitive to small changes in assumptions and inputs.

Based on an Exit Multiple Valuation, using a 25x Free Cash Flow multiple, or 4% FCF yield, Pushpay shares would be worth $2,8 US a share (assuming about 1% growth in outstanding shares per year). We use this exit multiple because this would be a more appropriate multiple to value a (capital-light) more mature software business with still some growth ahead. More mature software businesses often trade at a 20-30x FCF yield, sometimes even higher. This would imply a 19% IRR over the next five years from today’s prices. Such a high IRR presents a compelling opportunity to compound our capital at an above-average rate.

Conclusion

With this information about the company and its opportunity, we think this could be a good investment profiting from secular tailwinds in an interesting market. Pushpay currently is a dominant player in a market bound to experience further digitalization.

Our question marks around the leadership could be explained by asking the following question: Is the exit of the founder and the largest shareholders a reason not to own this business?

There are two angles we think are valid. The first angle would be to see this as a no-go. It is a red flag to many investors and could be a reason to pass on this business.

The second way to see the situation could be that the business is now in a new chapter in its development. The company is now cash flow positive and has seen an inflection point in its profitability. It is time for the New Zealand leadership to hand over the reins to a more US-centric management and shareholder base, after all, this is a mostly US business. The entry of a credible shareholder willing to take a 15% stake, the appointment of an American CEO, and the exit of controversial shareholders indicate that this might be the narrative the company is trying to create

While we recognize that this is a reason to keep a close eye on the situation, we believe this question mark is the reason this opportunity exists. The good performances before and during the Covid pandemic give us reason to believe this company will continue to dominate the US faith sector and has a long runway for growth. A US listing, more stability at the company, and continuing its good performance could shift the narrative around.

Disclaimer: Always do your own research. This is not investment advice and for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blog.